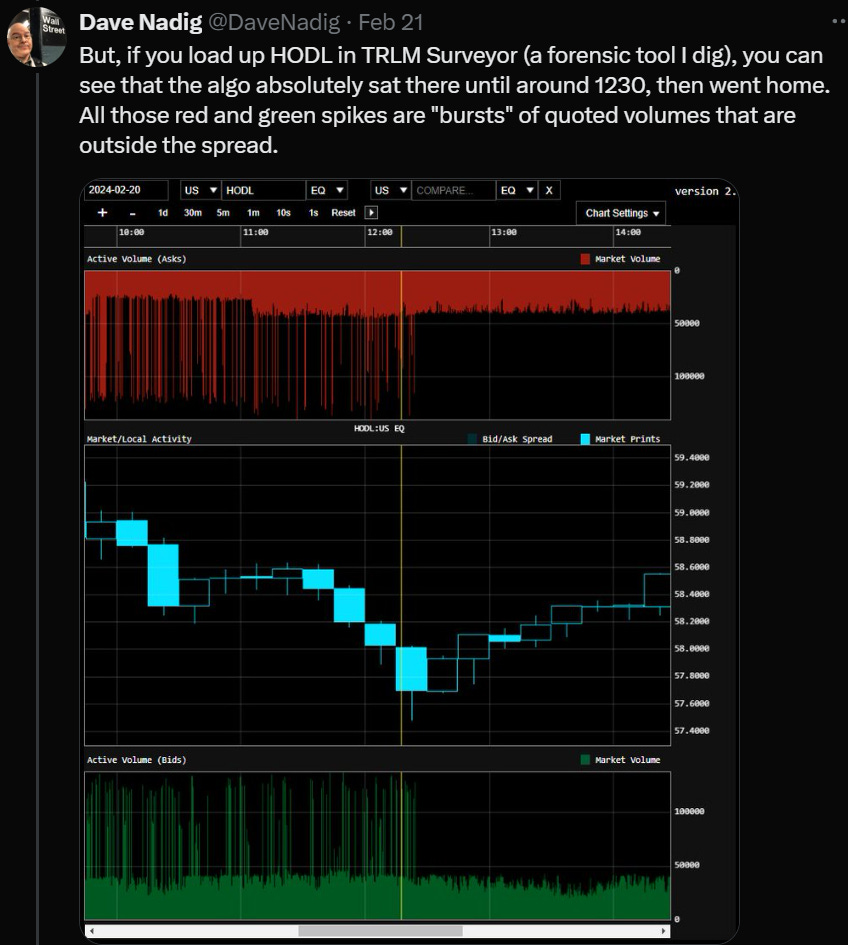

I’ll be honest, I’m a bit irrational in how much I love “reading tape” — that is, digging into the tick-level data on whatever the interesting story of the day is. Since the BTC ETFs have launched, I have been reading a LOT of tape, and I gotta tell you, its been snoozeville. The best thing I could come up with until this week was the day I saw the high frequency trading algos show up in the complex:

But that’s both a good thing, generally (spreads come in), and also not exactly news in this “speed-uber-alles” world we’ve lived in since Reg-NMS passed in 2005.

But, after weeks of really looking, I think I have found one BTC ETF trading anomaly. Unfortunately, I don’t think anyone can bank it.

BTC ETF Creation Mechanics

How does new BTC end up in an ETF?

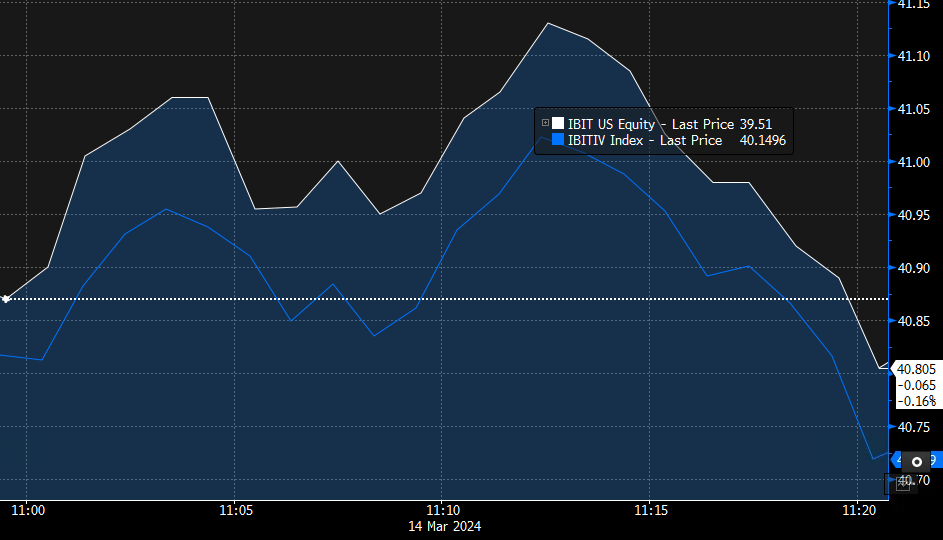

Step 1: An Authorized Participant (AP) notices that the ETF their tracking is trading for more than it’s worth. A common way of measuring that is the price the market maker could sell at right now (their offer price), vs. the intraday Net Asset Value of what the fund holds (INAV). So for example, here’s IBIT vs IBIT’s INAV yesterday:

It’s hard to see much gap there, because ETFs are so darn efficient. If you zoom in on this, you can see a slight persistent premium during this 20 minutes of trading

Step 2: If the gap is wide “enough” to make money the AP pounces: perhaps selling 50,000k shares of IBIT at 41.13 here in the middle of the chart, but knowing they can hedge that by buying something with Bitcoin Beta at 41.03 or so (usually a very easy-to-trade instrument, like futures, another ETP, or even making a trade on a BTC exchange. This part can be different between APs based on how they’re set up).

Step 3: At 2:30 or so (whenever this particular ETF has set it’s cutoff window for creations), they let the issuer know “hey, we’re gonna create 50k shares eh?”

Step 4: Between 3 and 4 (the timing can vary based on the precise tracking methodology used), the issuer goes and buys 50K shares worth of Bitcoin.

Step 5: Overnight, the AP’s account is credited with 50k shares of brand new ETF, and their cash account is decremented the cost of the whole trade the issuer made — including any slippage, transaction costs, etc. All of that is usually eaten by the AP.

Every ETF that does cash creations, whether its Bitcoin or Junk Bonds, basically works like the above. There can be some subtleties in timing (is the NAV going to be struck at 4PM last trade? Or in the case of most BTC ETFs, based on a window of trading activity before 4PM?) But this is the structure that keeps pricing close to fair value, and generates all those big flows numbers you see.

Sidebar: It’s perhaps worth noting that each creation order results in a round-trip into bitcoin-beta from the AP (putting on the hedge, then unwinding the hedge), and a one-way buy from the issuer. This really only has the effect of inflating perceived ecosystem volume.

How are BTC ETFs trading?

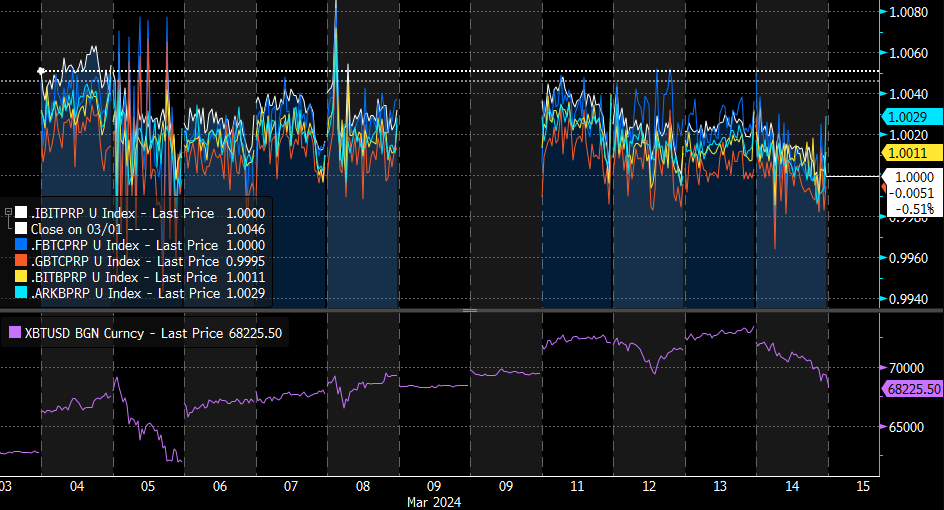

Pretty great honestly? In order to track these things I generally make a little custom index in Bloomberg that divides the last price of the ETF by it’s INAV, so a 1% premium would show up as “1.01” regardless of the handle of each ETF.

So here’s the last 9 days of trading amongst some of the big funds in the space. The way to read this is that on average, it seems that BTC ETPs trade somewhere between 10 and 60 bps over fair value in this window where things were mostly going up, with an average of around 10-15bps in normal moments.

You can see back on the 5th that all hell broke loose because BTC had the temerity to go down a little — and that inverts the math — now the AP will want to see a discount before acting, and indeed, however briefly, they all traded to slight discounts as a few folks hit the sell button. Volatility widens the gap.

Why Are There Differences?

One thing that should be obvious is that they’re not all the same. One reason is the differences in benchmark methodologies. The most used benchmark is the NY Bitcoin Reference Rate calculated by CF Benchmarks, which is used by IBIT, EZBC, BITB, BRRR, ARKB and BTCW. This makes it VERY easy for an AP to monitor all 6 and use them, essentially, as hedges against each other. Which makes it very curious that this pattern below is 100% consistent:

This is the premium on iShares Bitcoin Trust (IBIT) vs Ark 21Shares Bitcoin ETF (ARKB), Day after day, tick after tick, IBIT trades at a bigger premium than every other ETF tracking the same benchmark, and, eyeballing it, it’s averaging abotu 8-10bps? So what’s going on?

While I don’t know in any “inside information” sense, I have a strong suspicion.

When an AP is deciding how wide to let an ETF run, what they’re really doing is managing their risk. They demand a wider gap if they’re going to get saddled with extra costs. With all the BTC ETFs the actual trading happens at the issuer, but is paid for by the AP, so this gap is an auction between APs on how good the execution of the underlying is going to be.

So why would IBIT be “the worst” in this case?

Prime Brokerage

When you sit on a fund desk managing something less boring that U.S. equities, you have a couple of ways to trade. If you’ve got all your plumbing humming and you are well known in the market, you can often get the best execution Over the Counter (OTC). This means, either literally or notionally, calling up Jane Street or whomever and negotiating, booking the trade, and settling up overnight.

They could instead leverage a “prime broker” who will essentially handle an enormous amount of back office headache and act as the agent for trading. I used to do this back in 1999 when I ran money poorly. It saved us enormous backoffice costs, and we were nobodies who didn’t have hotlines to good counterparties.

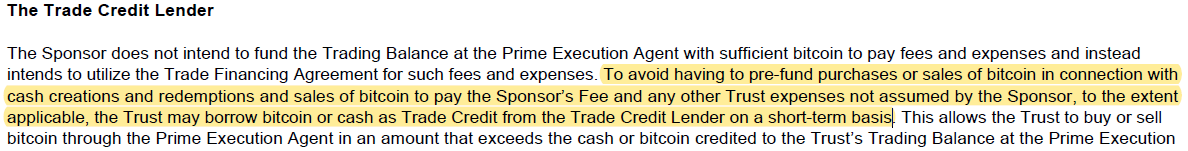

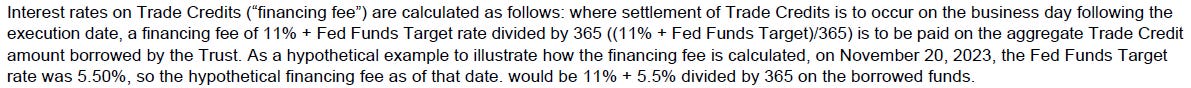

BlackRock has (I believe uniquely) gone out of their way to discuss how they use prime brokerage to facilitate their trading in their filings:

So far so good — this means that instead of BlackRock having to have all sorts of established OTC relationships and support rails, they can just “prefund” all their trades with Coinbase Prime, and then when the cash from the creates ends up in their accounts, they unwind these “trade credits.” It makes operations very smooth. But it’s not free!

If you’re wondering what that works out to, its about 6 bps a day.

Can You Bank This? No.

That’s my guess on what’s going on here. The APs know that they will get hit with these trade financing costs, so they let IBIT run wider than they let other, less liquid funds, tracking the exact same benchmark.

But before you get excited, remember that we’re talking about maybe a 10bps gap. If you, constant reader, genuinely think you can make money buy pair trading IBIT vs. ARKB (Short IBIT/Long ARKB) to scalp those 10bps from market makers who have access to every liquid BTC market in the world, infinite capital and fiber-optic veins, well, have at it. But you’re wrong. (Of course, if you’re just a normal buy-and-holder, it’s reasonable to question whether you want to be the one paying the premium for this, but that’s your call!)

Is This “Bad?” Meh?

What I suspect is happening is that BlackRock got caught just a little by surprise and has had to lean on CoinBase prime to handle the volume they’ve received efficiently — a choice I would have made in the same seat. After all, they, and most issuers, expected to be doing in-kind creations (where this issue would not exist) almost up until approval. Many of the other competitors (21 shares, Grayscale, Bitwise, etc) have been trading crypto for years and years, and have extraordinarily well established trading relationships they were able to immediately leverage.

Give it a week or a month, and I suspect this gap completely evaporates as BlackRock starts trading OTC.

But it was a fun rabbithole to chase, even if there are only a handful of un-arbable bps at the bottom.

P.S. - I Award One Demerit!

No, not to BlackRock, like I said, this is just nerdy plumbing I would have handled the same way.

No the Demerit goes to Grayscale.

Over the last week I’ve gone and read through *all* the docs I could again, to see if I missed some nuance in index methodology or whatnot.

Grayscale does not publish their prospectus. Seriously, go look. Fact sheets, marketing materials, Bitcoin education, sure, but if you want the prospectus, here’s the only use of the word on the whole website:

The don’t even link to the SEC, they just suggest that the average mom-and-pop investor go find EDGAR, or make a phone call to Foreside Fund Services.

The 1980s have entered the chat. Sheesh. (Here it is, saved you half an hour of looking).

Fascinating read, as always. I love the deep dive!

Interesting point about Grayscale. I'd always thought that issuers were legally required to publish the prospectus on their websites, but from what I can see the language is on the website OR by checking EDGAR. From https://www.sec.gov/about/reports-publications/investor-publications/introduction-mutual-funds :

Mutual funds and ETFs: You can research a mutual fund or ETF by reading its prospectus carefully to learn about its investment strategy and the potential risks. You can find the prospectus on the mutual fund’s or ETF’s website or on the SEC’s EDGAR database and download the documents for free.

Like you, I can't think of a single instance in which an issuer didn't readily provide this information to investors. What an easy and obvious thing to do; I can't understand why they wouldn't. Bizarre.