ETFs in 2024: Prediction Time!

The industry is definitely mature. Now the competition gets brutal.

ETFs: The Local Optimum of Capitalism

There’s a good reason that after 30 years, I’m still yammering on about the ETF market. It works. At this point you can read any number of excellent books on the history of indexing and ETFs (including the CFA book I helped write), but the overarching narrative is that through skill, luck, lobbying and good marketing, for the vast majority of investment use cases, the ETF has created a local well of optimization. ETFs have largely won every battle they’ve decided to wade into — especially now that the spot Bitcoin ETFs are trading. So here we are: 8 Trillion dollars, thousands of funds, covering every major and minor liquid asset class in the world, generally in the cheapest, most tax efficient package available anywhere.

In short, yay, we won. Almost any significant movement of money that goes through the public markets now goes through ETFs. Any question of that disappeared in 2020, when the fed used Bond ETFs as their vehicle of choice for the Secondary Market Corporate Credit Facility (SMCCF) in 2020.

ETFs: the discriminating choice for Central Banks the world over (just ask Japan, at half a trillion dollars).

So what now? Now it gets hard. Now it’s scrapping over conversions, market structure, and distribution, not investing. So we should stop paying attention? Rookie mistake. Now’s the most important time to pay attention.

Share Class Shenanigans

Prediction: >1,000 new ETFs in the next few years.

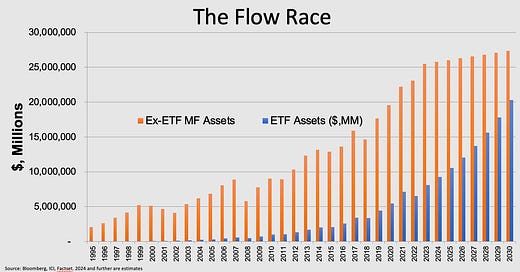

The battle between mutual funds and ETFs is largely one manufactured by ETF nerds (hand up) over the last 20 years, because when ETFs were the hot new shiny thing, it was an interesting horse race. I used to maintain a chart showing ETF and MF assets crossing over at some point in the future. For funsies, I re-ran it:

It ain’t gonna happen soon. What happened wasn’t some failing of ETFs — the flows from traditional active to passive ETFs remain inexorable. What changed was ripping bull markets lifting the larger pool of mutual fund assets higher, a massive influx of money market buyers in the pandemic, and in general a fixed income focussed few years (where traditional Mutual Funds have more traction).

So will that persist in a world where issuers start just slapping ETF share classes on their mutual funds now that Vanguard’s patent is out of the way (as of May 16 last year)? Mostly I think this chart stops being relevant, and we end up with EVEN MORE ETFs to have to pay attention to. In general, this will be good for investors in those funds that have new ETF share classes, as the ETF share class may help “wash” some of the tax overhang (by using existing low-basis lots held in the mutual fund as the lots for any ETF redemptions), while at the same time putting pressure on fees. So, sure, it’s a “good thing” but I don’t think all that dramatic in terms of real world investor impact.

What about 401ks?

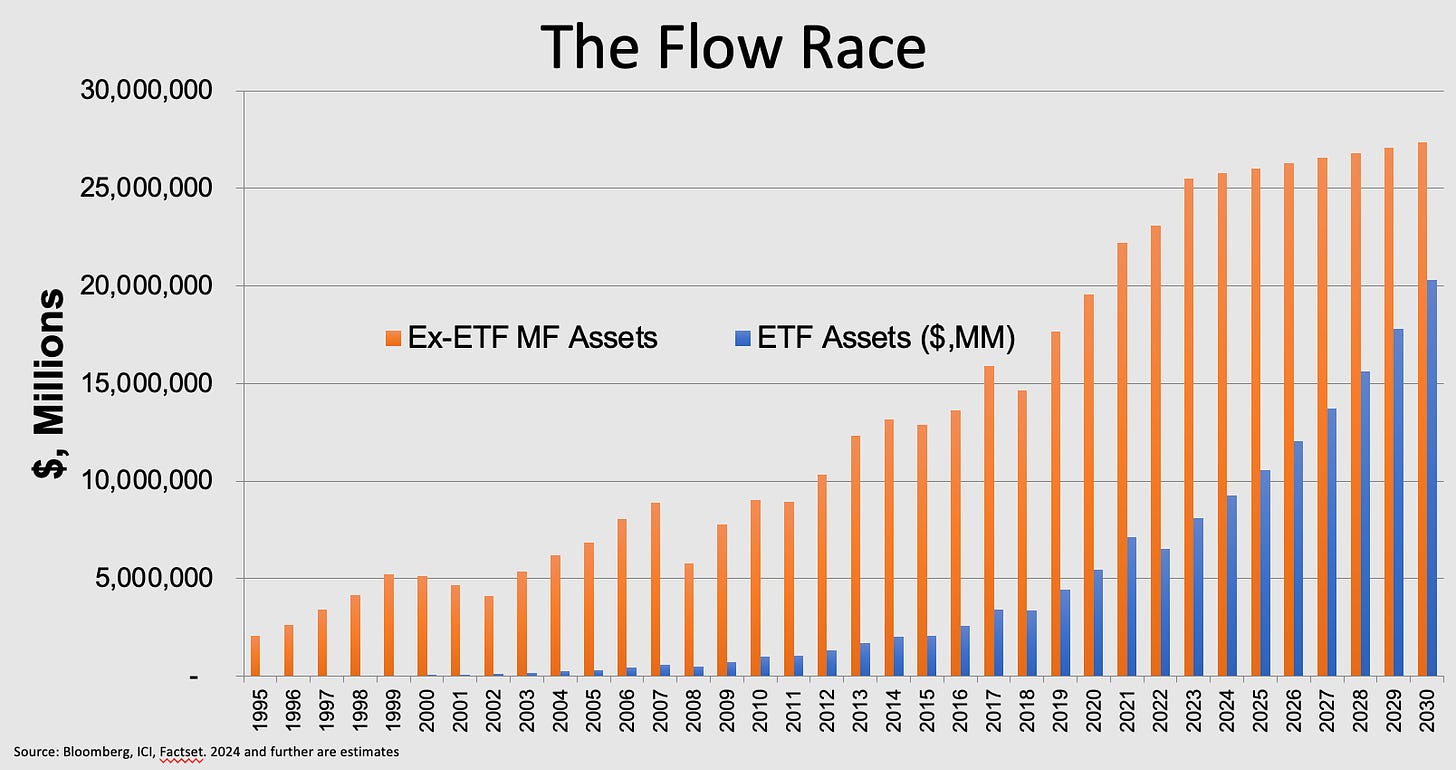

Meanwhile, the other stalwart growth vector for traditional mutual funds — the Defined Contribution retirement plan — is itself moving away from ‘40 Act mutual funds as fast as they possibly can. From the (always excellent) ICI Factbook, 401ks matter a LOT to mutual funds right now:

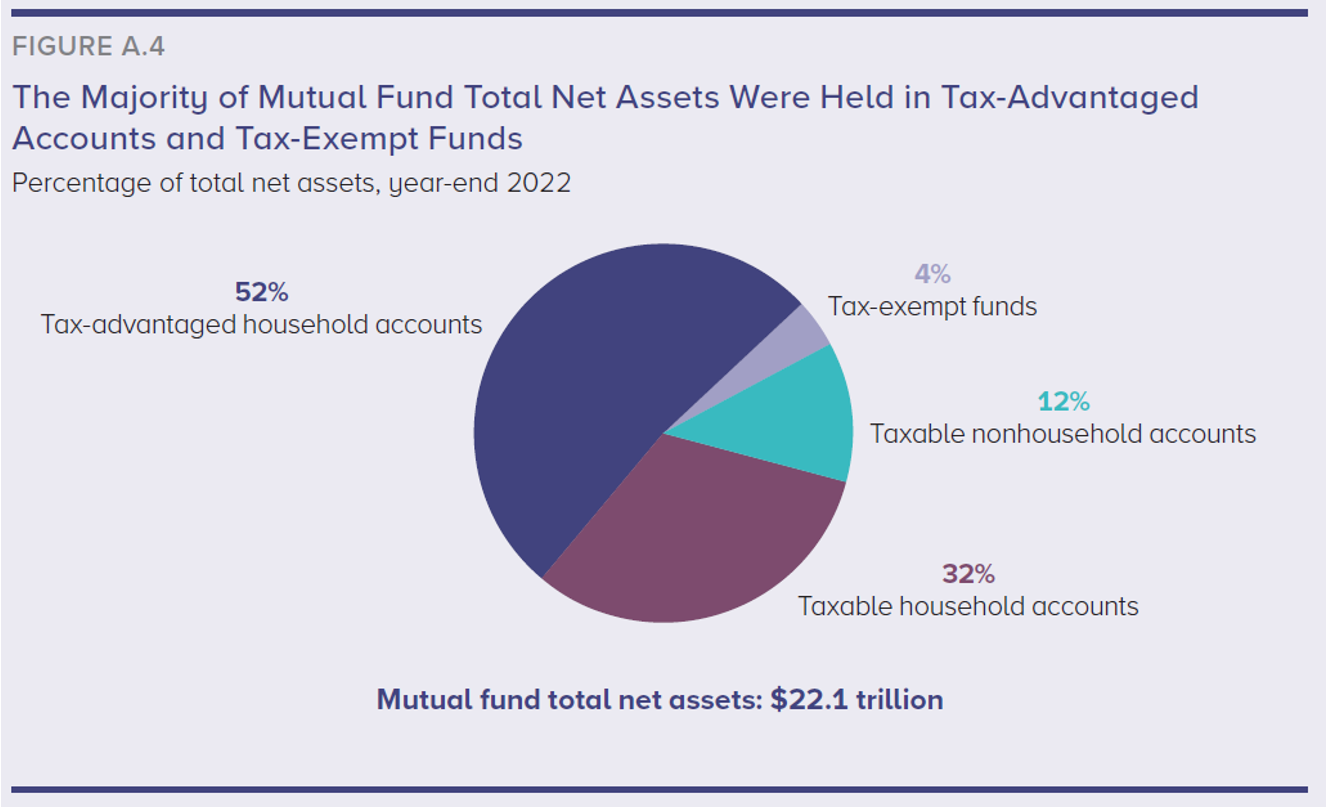

But at the same time, every big plan is pretty much moving to Collective Investment Trusts:

CIT’s aren’t regulated by the SEC, they’re bank-regulated and governed by ERISA, and that gives them some advantages: they can be cheaper, more flexible in terms of how fees are collected over time, and simply require less of the asset manager than using traditional mutual funds. Essentially, they allow big plans to shave pennies off their expenses. There are some governance differences (here’s a great analysis by Wilmington Trust) but it’s well understood and not controversial.

The next leg will be things like 403b plans using CITs (currently not allowed, but more trillions of dollars) which would kick a lot of insurance and mutual fund sales people (who dominate the 403b market) to the curb. All that CIT movement only comes out of Mutual Funds, since ETFs don’t really play in the 401k market, and despite decades of smart people trying wedge ETFs in to 401ks, they really don’t make any sense: the tax and liquidity advantages are irrelevant.

So, no, not a big source of new interest for ETFs, quite the opposite.

Section 351 SMA Conversions? Yup.

Another source of new ETF assets that I expect to trickle in is the conversion of advisor-managed separately managed accounts to ETFs. This idea definitely has some legs, as there are lots of advisors out there — particularly those focussed on the super high end of the market — who run SMAs for their clients with very specific strategies. The “Section 351” comes from the IRS code that allows these conversions to be done without tax implications, and for some advisors and their clients, a conversion means more liquidity, and potentially even better tax treatment.

Pinning down real data on “the SMA market” is essentially impossible — SMAs are used for very specific reasons in things like Muni bonds and hedge funds, and nobody really produces reliable overall data (that I’ve seen). But I have been hearing enough about it to think the trickle of SMA conversions are going to balloon.

Prediction: within 2-3 years, we have more than 5,000 ETF tickers trading, with a few hundred of those share classes from traditional mutual funds, a few hundred SMA conversions, all while CITs quietly continue their takeover of the retirement market. Welcome to the ETF Analyst full employment program! Congratulations to Morningstar, VettaFi, ETF.com et al! Advisors are gonna need all the help they can get.

Pay-to-Play

Prediction: We’re gonna talk about revenue sharing a lot more.

Imagine your an upstart ETF issuer. You’ve got your 4-10 funds going, you have $100 million or so in assets. You’ve got a 1 year track record. Time to start knocking on the doors of wirehouses, regional broker dealers and advisor gatekeepers like Fidelity or Pershing or Schwab right?

Hope you brought your checkbook.

Pay-to-play … that is, when the distribution channel charges the fund manager for, effectively, shelf space … is hardly new.

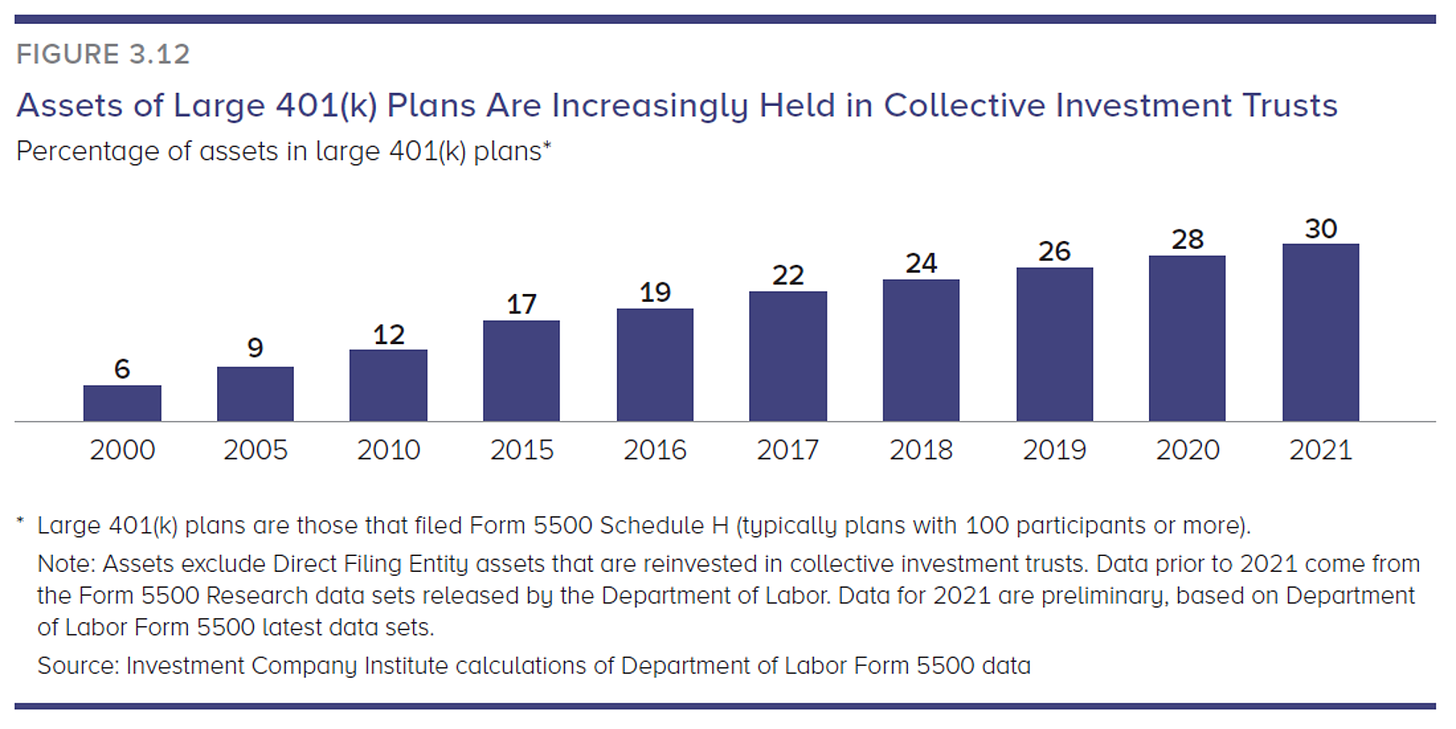

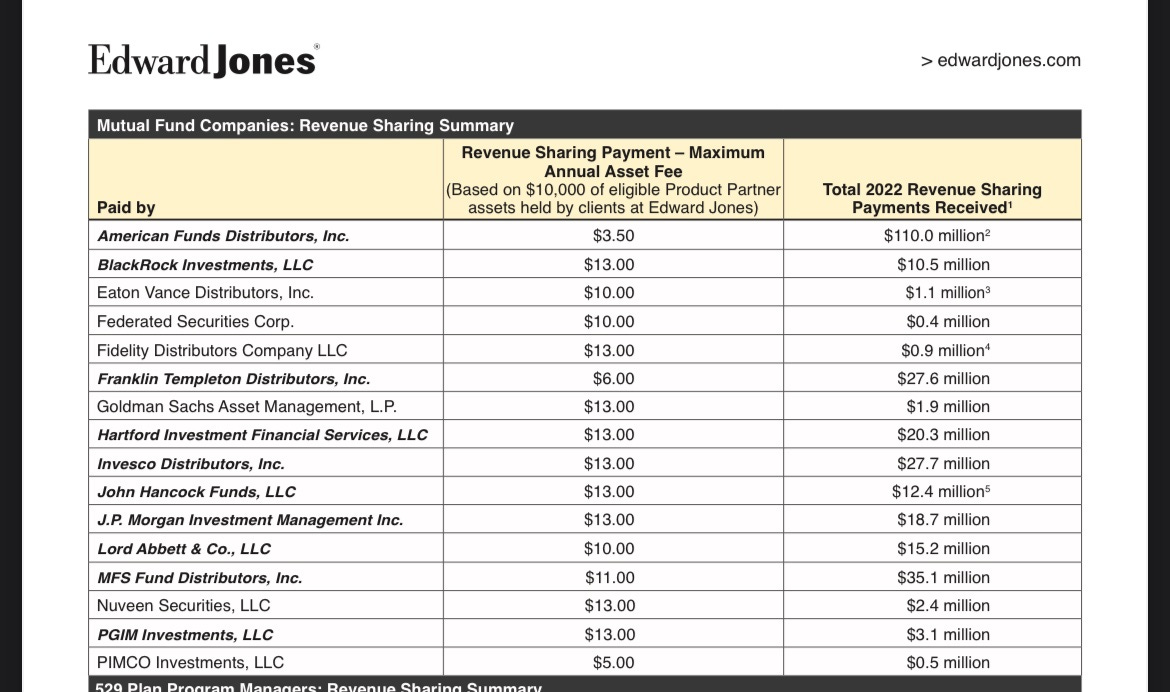

Here’s a fun table from Ed Jones making it’s way around the internet, outlining how much revenue sharing they received from fund issuers in 2022. It nicely lays out “OK, so they charge American Funds 3.5 basis points (0.035%) on all the assets in the firm from that company, for a total of $110 million. That’s obviously a lot less than the 13 basis points (0.13%) they collect from Blackrock:

Over the last 30 years, what asset managers “get” for this, and even how they “pay” for it has shifted. Sometimes, what’s expected is that all the asset managers kick in to sponsor a sales meeting or conference. Sometimes it’s just raw “platform access.” Sometimes it’s a kicker to be included on various forms of “approved lists.”

Increasingly however what we see is just a raw basis point ask. Sometimes they ask issuers for a flat number of basis points on any assets held in certain funds on the platform — which of course only works if there’s enough money to go around, and I don’t know if you’ve noticed, but ETFs can be cheap.

Is any of this against the rules? Absolutely not. It’s so not against the rules that the above table isn’t a “leak” — its featured prominently in their disclosure pages under “Revenue Sharing.”

Part of why I dig how EJ is doing this is because it is in fact so clean. It’s just written right there. And in fact, I give EJ some real credit for how well they produce things like their RegBI disclosures — they’re actually readable! Of course, EJ is a firm with 50,000 “associates” some of whom are really fee-only planners, and some of them are product salespeople, and some of them are saints, and some of them are shady. I feel confident I can say that about ANY collection of 50,000 individuals in this business.

So why do I bring it up? Because I suspect these kinds of relationships are going to get more and more scrutiny. I’m very much a “pro-transparency” guy, so I could see how some group of investors, or lobbyists, or lawyers, might try and make this seem against the rules enough to try and get the actual rules changed.

Pushback? Expect it.

But it’s the issuers themselves who may end up moving the needle here, because the math doesn’t work.

I know everyone loves to hate on big index managers like Blackrock, and I too am not losing sleep over whether they make their quarter. But 13 basis points is a *lot* of money to pay out of an ETF expense ratio, especially when you can see your competitor only paying 3.5. Blackrock’s Core ETF series has an average ER of just 7 basis points.

Eventually, any expense at a fund issuer will eventually be born by investors through expense ratios, and if you’re a new issuer, coming to market with cheap products is nearly impossible when you know you’ve got a bill like this coming the moment your successful.

Prediction: We here a lot more handwringing from issuers — and media — about pay-to-play in the next 3-4 years. I wouldn’t be surprised to see this get caught up in the hype cycle.

New Asset Classes? Or new Packaging?

Prediction: All the interesting new funds are either trades or portfolios.

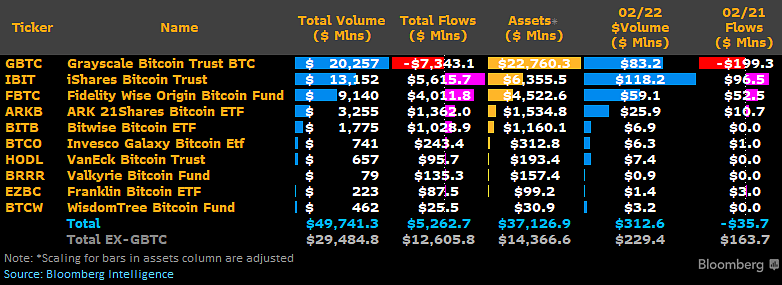

Hey, did you notice spot Bitcoin ETPs launched? (Courtesy James Seyffart at Bloomberg).

The whole race to get BTC into an ETF Wrapper is just the latest in a series of “ETF-izing” a new asset class, just like we did with Stocks in 1993, Bonds in 2002, Gold in 2004, and oil in 2006. There aren’t actually all that many assets left in the world to wrap in an ETF, but what’s left — from DeFi tokens to physical uranium — all share similar characteristics: they’re illiquid, or have some “hair” on storage and settlement (good luck warehousing your yellowcake in a JP Morgan vault, or navigating what the heck a DeFi token even is under U.S. law).

A common question I get is whether this or that ETF owns things that are “too illiquid.” Junk bonds are usually the thing that break peoples brains, because it seems impossible that ETFs like JNK and HYG trade like water when their underlying bonds trade by appointment. Ultimately, these illiquid assets work in an ETF wrapper largely because they have become tools of the same industry that trades the underlying.

Put another way, if your a junk bond trader, or buyer, you absolutely keep all the junk bond ETFs on your screen, all the time. They’re your liquidity valve. Got a piece of garbage on your book that you can’t get rid off? Short some JNK. It’s not perfect, but it’s going to move the same direction for the same reasons.

Is there a bridge too far? Yup.

Private Privates are Private for a Reason

The rise of interest in things like “private credit” or even just plain old “private equity” trading gives me pause. I don’t think it’s necessarily a great idea to take something like CartaX and wedge it into a daily traded vehicle. I’m sure folks will try, but since 2016 we’ve had a pretty good rule from the SEC on this, and they are actually busting firms for things like just hanging on to 20% of a private company in violation.

So while I suspect we crack open Ether and maybe a few new futures buckets, I think it’s very unlikely we get even more illiquid underlings into an ETF anytime soon. Instead, I think pretty much all new ETFs that come to market that aren’t simply a conversion from a different pool of assets fall into two categories:

Packaged Trades: Single ticker solutions that make a multi-leg trade into a single leg-trade. BOXX from Alpha Architect is a great example, as are everything from the leveraged ETFs to single-stock options strategies like TSLY from YieldMax. Neither is brand new intellectual property, instead they’re convenience packaging.

Packaged Portfolios: In the U.S. market, we don’t buy a lot of “one ticker” solutions for a whole portfolio, but in other markets like Canada they’re a big deal. I don’t expect a massive shift in that dynamic, but as we see more share class entries, we’ll get some asset allocation and target date funds in the mix. Ideas like Return Stacking get traction for simplifying portfolio trades.

Prediction: The pace of green-field new assets slows dramatically, while new ETF innovation comes mostly from packaging up things folks could otherwise do on their own.

The Endless Active/Passive Debate

Prediction: Evidence for passive effects piles up, but we do nothing about it, because it’s more fun to yell at Blackrock then rebuild American market capitalism.

Are passively managed funds worse than Marxism? Every few years I seem to have to revisit this issue (last time was 2 years ago for ETF Trends). The points I made then still stand as far as I can tell:

Yes, the ever-increasing prevalence of passive investing does create all sorts of follow on consequences, including concentration, correlation and valuation issues, with a fading IPO market, increasing use of private equity, and “inelastic” markets where flow drives price more than valuation. This was largely the conclusion of David Einhorn in his recent Masters in Business podcast with Barry Ritholtz, and echoes the work Mike Green continues to do (you should pay for his Substack, I do). I’ll write a Long, Long piece on this at some point, but yes, Virginia, passive investing does impact markets, market structure, and capitalism generally.

We will not as a society do a darn thing about it because, as I wrote two years ago:

“But almost regardless of your stance on any of those real issues, there is one overwhelming truth that’s difficult to get past: In 1978, we, as a country, decided to outsource retirement entirely. Yes, Social Security still exists, but ever since 1978, almost every piece of public policy has driven the ability to survive in society after the age of 65 or so into the hands of the individual with a single toolset: the market. We codified and recodified and reincentivized corporate America and the individual to plow money into the market, from George Bush’s ownership society to Obama’s “myRA” attempt, we, collectively, built the infrastructure to put us right where we are.”

In other words, the 50% of the mutual fund market that is in 401ks — tens of trillions — is largely in indexes and target date funds because we told every single working American they had to “participate” in the stock market if they wanted any chance of retiring. I suspect most participants would rather just know they’ll be ok when they retire. But you cannot ask the entire country to become active stock pickers, or to enter the unwinnable horse-race of picking the “right” active manager for 30 years running.

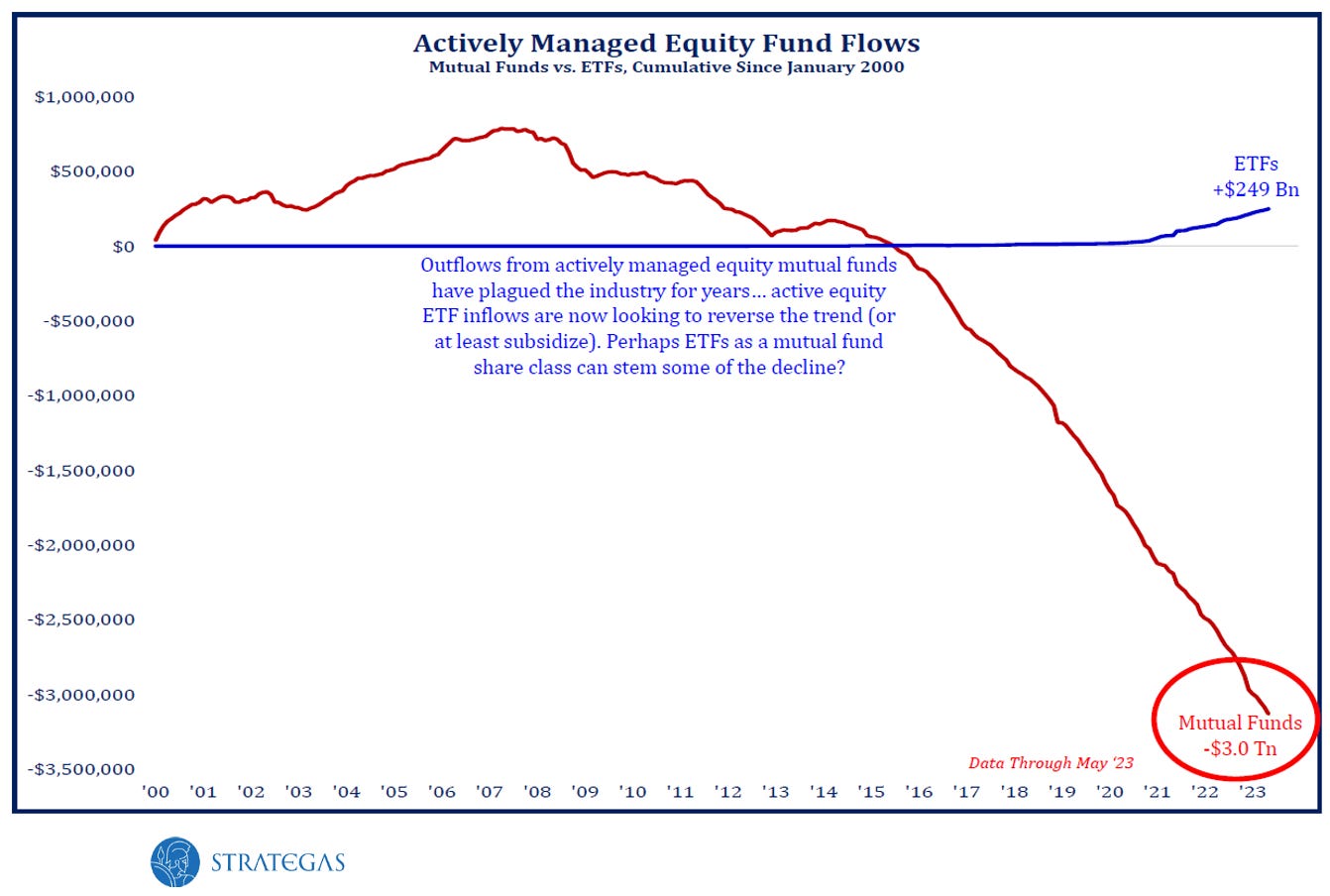

Of course, active is hardly dead, just the old-school, overpriced active that hugs the index is dead. As Todd Sohn from Strategas asks: maybe more cross pollination between funds and ETFs fixes this? Or maybe that 3 Trillion in lost active never returns.

It’s Alive! Active ETFs

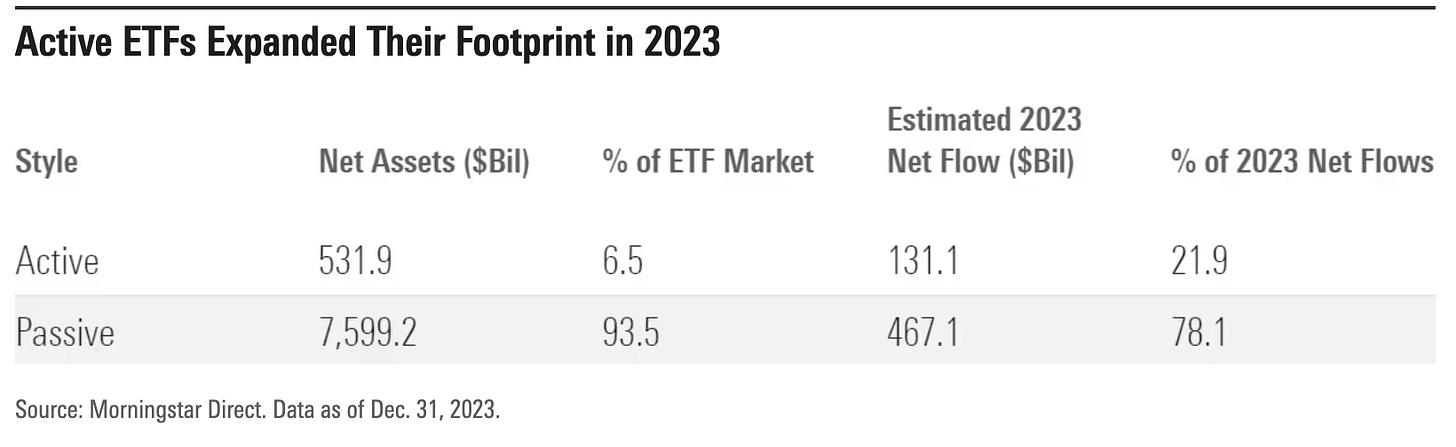

But also: $250 billion into active equity ETFs isn’t nothing, and in fact, if you look at 2023 overall, it was just an incredible breakout year for active managers in the ETF wrapper. From Morningstar:

22% of flows last year went into active products — thats just enormous given the very low base going into the year. Of course “active” is too big an umbrella. In those flows you get everything from fairly conservative equity-income products like JEPI, go-anywhere bond funds like BOND, shoot-the-moon funds like ARKK and derivative based products like Innovator’s buffered funds.

We could split hairs about which funds gained assets and why and what’s “really” active or not, but the reality is that in the ETF space, this story is changing, and when you ask advisors in polls, they respond over and over again that they like having active in the mix.

So while the Active/Passive debate will never die, it does feel like we’ve turned a bit of a corner on the ETF side. Which will do nothing to deter 401k savers from using passive target date funds till the end of time, but still, perhaps it can soften the impact. (And no, I’m not that worried about Boomers selling all their index funds crashing the market… that’s been about to happen for 25 years and still doesn’t seem to matter. The global appetite for U.S. stocks seems unwavering over the long term)

More Fun to Yell About: Voting

One of the big reasons we won’t actually pry open the tax code and change market structure is because it would require really hard choices around things like “should the Feds be in the retirement game at all.”

It’s much easier to point fingers at the big indexers and claim they’re the ones breaking everything because they own too much. Blackrock and Vanguard do each own about 7%of most companies public equity. Mostly, they get in trouble when they try to do anything but vote with management. The argument goes that as “passive” holders they shouldn’t really have a vote in how companies are run. This, again, is something I write a tome about every few years (last time was 2 years ago around the INDEX act).

That’s a dumb argument, of course, because they don’t own anything. Fund shareholders own those companies, and Blackrock is just the middleman. But it’s much easier for politicians to make big showy stands against big bad corporate control than it is to pass legislation fixing anything, so here we are.

And of course, even when Blackrock does exactly the right thing by developing a not-easy-or-cheap way for fund shareholders to pick their proxy strategy, they’ll still get guff for it. It doesn’t matter, despite the PR headaches Blackrock’s ESG business is raking in assets because, sorry politicians, lots of people want to BUY these strategies, even if you don’t want Blackrock to SELL them.

Prediction: We’ll spend the next 5 years pointing fingers at passive anytime the market seems “weird” and do absolutely nothing from a legislative or regulatory perspective to change anything about our current market structure, while we instead chase the “too much power” canard.

Do ETFs Still Matter?

Given my preamble that ETFs are now scrapping for position, not reinventing investing, does the ETF market still matter?

More than ever.

The ETF has become the “common knowledge” way to invest, the same way Mutual Funds were the “common knowledge” way to invest in the 1980s. Ask essentially any investor under the age of 40, and they’ll cop to owning mostly ETFs as the core of their holdings. Anything becoming the “default” way of doing things is both a little scary and a little exciting.

The scary part is that it’s easy to stop paying attention. Sure, “everyone” covers ETFs now, but there’s a very big difference between “covering” ETFs and knowing whether something is weird or broken or not. Since “everyone” uses ETFs, that makes them more of a target for bad actors and shenanigans.

At the same time, anytime an industry starts ossifying, there are always, always opportunities for disruption. I don’t know what the form of disruption will be: it’s probably not the direct indexing or robo advisor or DeFi projects we can all see today. But the disruption is inevitable, and likely comes from a regulatory hack I haven’t seen or thought of yet.

But yes, the ETF market matters a lot because honestly, it’s becoming “the market.”

Such a variety of topics, but the perfect platofrom for you to share your long history, knowledge and insights into the ETF market Good inventory of where we are at. I think the “active” dimension of ETFs is definitely on the rise and the “packaging” aspect is a big growth area, especially for ETFs that take advantage of option’s ability to transform capital returns into income and reshape return patterns. There are also very few successful multi-strategy ETFs, because that is what RIA’s and model portfolios cover. Perhaps this will be an area of competition down the road. I have always hated the “pay to play” and have been surprised how long it lasted. Hopefully, the clamor for broader access to ETFs by wirehouse clients will eventually win out - but I agree it will take a while, given the bull market backdrop.

Excellent overview.

And excellent choice of citation for the recent SEC enforcement action on violation of the liquidity rule!

FWIW I wouldn’t worry too much about attempts to provide access to private markets in the ETF wrapper; the division is just too sharp (even before the liquidity rule) and the action in trying to expand private markets access is occurring in other areas (I’ll tell you about them next time you swing through NY).

Lastly, one of these days I’ll pick a fight with you about the virtues of our retirement system (hint: it has virtues and they are underrated).