What's Missing from the '25 Predictorama

(Also, scoring a few from last year)

Are you tired of the 2025 predictions yet? I am. But this time, with a radically unusual political climate, geopolitical stage, cultural zeitgeist and tech boom, it seems as good a time as any to pause and think about the pivots we’re all walking into, whether we think our opinion matters or not.

My Mixed 2024 Predictions

About this time last year, I hopped on IEX’s excellent podcast, Boxes and Lines, and made some predictions. I’d say I was about half right. Here’s my scorecard:

Bitcoin ETFs: It was a slam dunk but I (and almost everyone in the world) predicted the approval of Bitcoin ETFs. I think my over/under on net new money was +$10B (or $30B in total assets by year end). I was under here by a lot (net flows were ~$40B).

Environmental, Social, and Governance (ESG) Investing: I was gulping the Hopium last year when I thought this would be a stable year for ESG — instead we had about -$10B in flows in US ESG strategies. Still some growth overseas, but ESG is likely back in the institutional doghouse, where buyers will still find sellers and meet their mandates.

Decarbonization and Nuclear Energy: I thought funds like NLR (VanEck’s Uranium and Nuclear Power ETF) would have a banner year, but mostly, they ended up looking like more volatile versions of the broad market. I continue to think this is a good play.

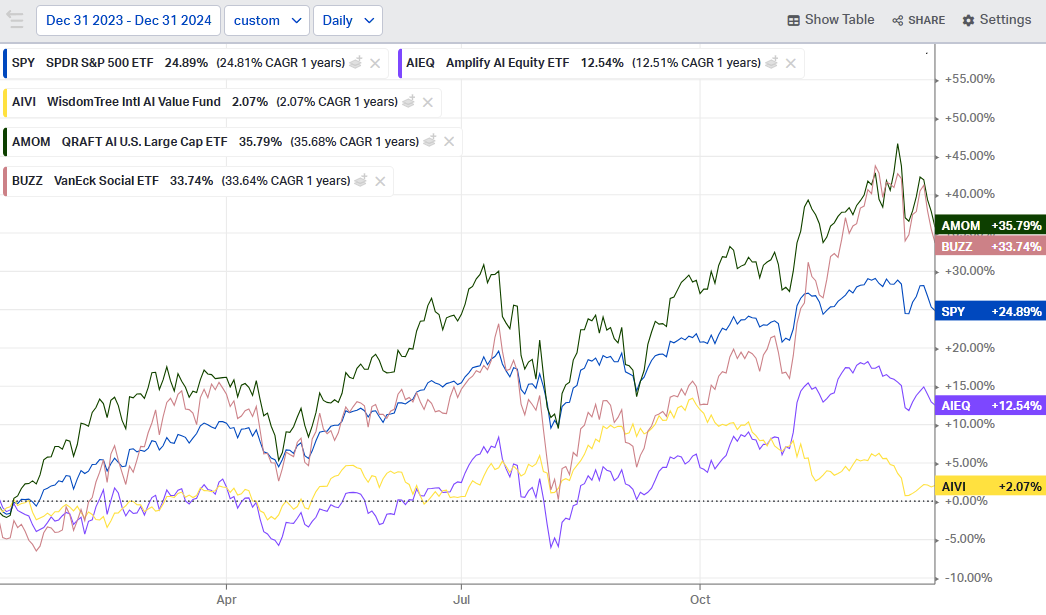

Artificial Intelligence (AI): My main prediction was the hype about AI *companies* was real, and I think I can call that a win. I also said I was not convinced AI stock picking would work. I’ll give myself a push on that: Core funds like AIEQ did poorly, Momentum and Memes did well. You can say that about their passive competitors as well.

T+1 Settlement: Was sure this was a nothingburger. It wasn’t even that.

My 2025 Predictions

Fortress America: While we spend the next 4 years drowning in wild and distracting headlines, underlying reality will be pure jingoism. However tariffs, trade, currency, mass deportations or the military invasion of Panama go, it will all be some form of bullying the world for the betterment of the U.S. economy. Whether you think that’s great or awful, I suspect it makes your international asset allocation decisions, which were probably already home-biased, even more home biased, and it’s hard to argue with. Buying China on a dip is a very, very bold move right now.

Immigration: Anyone speaking with certainty about how deportations will go, how they will impact disparate industries, and how markets will react is absolutely just making stuff up. These are wildly unknown, and the impacts on everything from Agriculture to private prison stocks will be significant — in one direction or another. The fight over H1B visas will get headlines, but is largely irrelevant in the short term.

Embracing the Corpostate Biden’s entire cabinet’s net worth was $118m. Just the 13 Billionaires formally up for cabinet positions in the Trump admin have a net worth of $382 Billion. That’s before we get to DOGE and the ring-kissing going on around the inauguration already.

Love it or hate it, betting against the corpostate oligarchy that will drive America for at least the next 4 years is a sucker move. My actual recommendations to friends (not an advisor) is to be basically as long as you can stomach in U.S. equity (so you can capture convexity), and be very conservative in your personal spending.Labor: Nothing over the next 4 years will make people like their JOBS anymore. Deregulated, anti-labor capitalism is going to explode the meaning crisis. People will be looking EVERYWHERE BUT their government and their employer for meaning and support. AI can’t grow up fast enough to make GenZ irrelevant. They’re the most pro-Union generation ever - Unions have an 88% approval rating with under 30s. Democrats are going to (or at least should) latch on to this with fervor.

Social Media is already tanking and this will accelerate. Attempts to wedge AI into what little real “community” exists on social are already being pulled back, and will likely face universal backlash when implemented. GenZ is already backing out, with 63% saying they’re taking a detox break in 2025, and platforms abandoning any pretext of moderation or content screening aren’t going to win customers back.

AI will continue to be unevenly distributed. We’ll get amazing agents in 2025, but they wont be free. $20 a month will give way to $100 a month very quickly for personal use. Yes, the immediate impact on some jobs (legal associates, coders) is real, but at the same time, these are Upper Middle Class jobs that nobody in Washington cares about. Sam Altman can handwave about Universal Basic Income all he wants, it ain’t happening soon. Anyone wanna bet we massively increase the social safety net in the next 4-10 years? Not me.

Private Markets for Grandma: The industry is gonna PUSH SO HARD and I’m gonna YELL SO LOUD. I’m not against the little guy getting access to good things. I am against the systematic plundering of retirement accounts by people who want to UNLOAD their private securities. It’s a very, very simple question. If you’re Apollo and you source $10B in deals in 2025, some of them are going to be GREAT and some of them are going to be AWFUL. Which bucket do you think the big institutions get first dibs on? FOREVER.

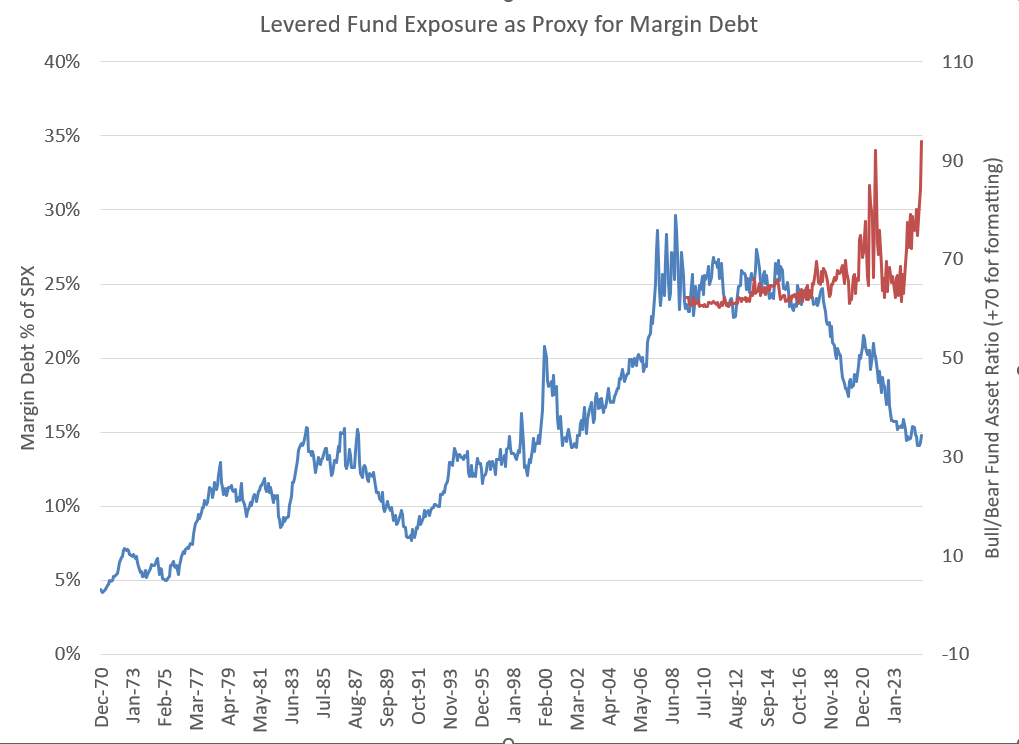

What Could Break?: Leverage, as always, but I don’t know exactly where and how. I do know with near certainty that Mike Green is correct, and it’s just a matter of time before this ends with tears as we find a new crack in the system:

I can say that while I absolutely think Passive continues to perturb markets, this is not likely the year that unwinds. If anything, I’m far more concerned with acceleration of the current top-heavy dominance, and the interconnection of the big index derivative venues with the whole ecosystem of products now unloading their excess exposure

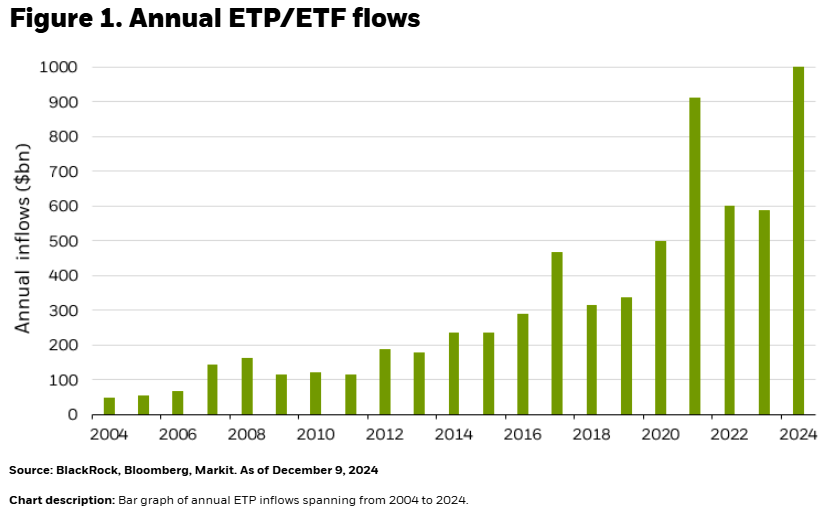

options greeks.ETF Flows & Launches! Can next year beat this years $1T in flows? Meh, maybe? If we have another 20% S&P year, we’ll have another $1T in flows. If we have a reset, we’ll inevitably get pullback in flows.

The two categories of 2025 flow gatherers are pretty easy to predict. As the market pushes more and more retail, investors will flock to headline chasing thematic products while traders head for the hot sauce. The hot sauce includes more crypto, in all its flavors. We’ve already seen a huge raft of filings for things like 100% downside protected bitcoin, income based strategies and multi-asset products.

On the more rational side, thematic ETFs are poised for a good year. (Disclosure, I’m an advisor to VistaShares, an upstart Thematic company). AI, GLP1 and other Medical discoveries, Quantum Computing, EVs, Electrification, Defense, Private prisons — there are plenty of fairly “obvious” corners of the global economy headed for growth. The challenge is always how much is already priced in.

An Even Weirder Year?

None of that seems particularly controversial, I suppose, and that’s OK. I suspect the really interesting headlines of 2025 won’t be about anything as mundane as interest rates, asset classes, crypto regulation or leverage.

No, I think this is going to be a very weird year. The number one podcast in the United States right now isn’t Joe Rogan, it’s the Telepathy Tapes, a set of interviews with autistic folks and their caregivers who, seemingly, share thoughts. We’re fully in the window for some radical Quantum Computing, AI and Neuroscience discoveries. We’ve got unprecedented transparency and official attention in Washington on UFOs. And none of that says anything about the bizarre geopolitical epileptic seizure we seem to be part of.

The challenge will be deciding what to pay attention to, what’s real, and what matters.