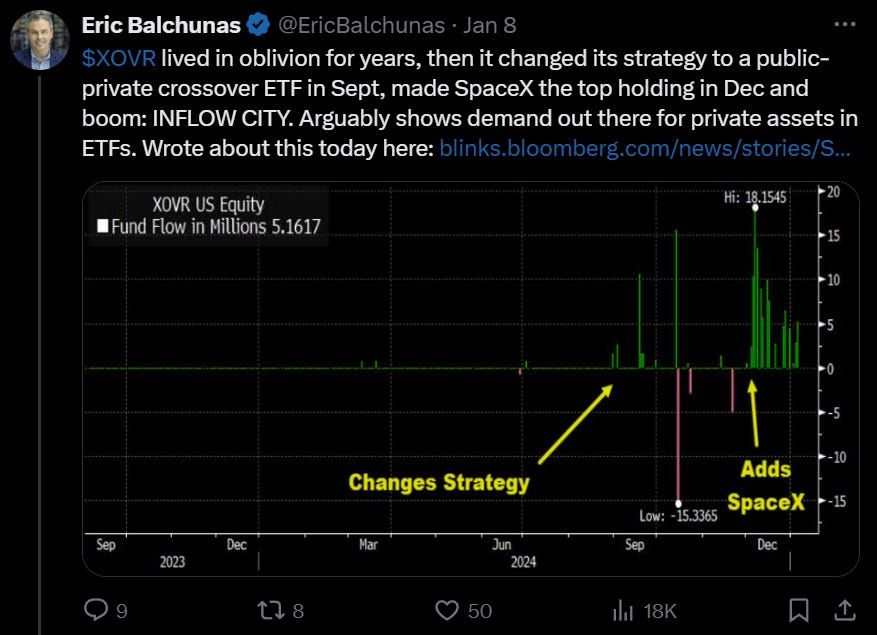

ERShares is a small ETF company that used to run an Entrepreneur-focused ETF (ENTR) that was going nowhere, until they changed the strategy and ticker (XOVR) to include a big slug of SpaceX, and turned the whole company into a SpaceX access marketing engine:

Which folks noticed:

On December Second they added a pile of SpaceX, a week before a tender offer that reset the price higher, booking investors an instant 37% gain. At least, that’s what the CEO says on Bloomberg this week. They don’t publish historical holdings or a trade blotter, so I have no idea.

Since this is supposedly the magic solution for private equity exposure — just load up your ‘40 act ETF’s 15% illiquid bucket — I thought it would be useful to try and show just how opaque and byzantine this is as a “democratization” of private exposure.

Background: Mutual Funds and Privates

First, just to to make something really clear, XOVR — like literally every other ‘40 act ETF and mutual fund in existence, has to maintain at least 85% of its holdings in liquid securities, leaving 15% of the fund technically available for less-liquid stuff. This is baked into the current rules, and the definition of illiquid is really easy:

“An illiquid investment is an investment that the fund reasonably expects cannot be sold in current market conditions in seven calendar days without significantly changing the market value of the investment.”

In implementation, a fund can’t acquire additional illiquid stuff if they are at 15%, and the day they strike an NAV where their privates are 15.01% of the portfolio, they have to immediately report it and go through a remediation process. Critical to that percentage is, of course, the price of the underlying illiquid security in question. And getting good prices on non-traded securities is hard.

This “prices R hard” risk, of course, is buried in the prospectus (as it is for literally every mutual fund):

The fair valued prices assigned to the Fund’s investments in private companies are based on a variety of factors, reviewed regularly, and updated as additional information becomes available. However, fair value pricing includes subjective judgments, and it is possible that the fair value assigned to a security may differ materially from the value the Fund would realize if the security were sold.

The buck — as it nearly always does — stops with the Fund’s board. Like every other prospectus you’ll read, there’s language giving them all the legal wiggle room to ensure nobody can successfully sue them, and allowing the board to set whatever pricing policy they want.

Importantly: I, the poor shlub deciding whether to give them my money, never get to see these pricing policies.

But that’s OK, right? SpaceX is a big company and lots of people own it, so it must have a price somewhere?

What is SpaceX worth at 2:31PM on Friday January 10th

When pressed on this by Eric Balchunas in the above twitter thread, here was the CEO’s response about pricing concerns and liquidity in SpaceX:

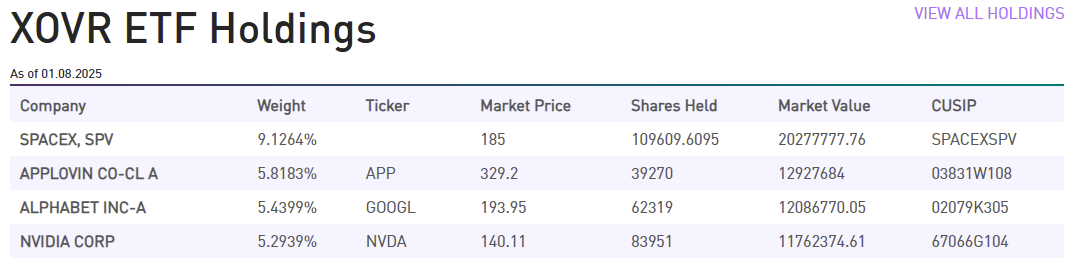

This is great! Now we know that the CEO thinks the company is worth $350B and is easy to buy and sell. Let’s go look at XOVR’s holdings right now and see how we’re going to get some of that juicy $350B pie:

OK, so, as of Wednesday (no updates since then) the fund held 109k shares at a price of $185. So if we give XOVR $100, we should have $9.12 of SpaceX exposure. But how do we know what SpaceX is actually worth right now? I know that XOVR is trading at $18.19, which is down from $18.47 last night. Is this a good time to buy? Since XOVR doesn’t publish an intraday fair value, I dont know if this is a good price, but I can look on my Schwab account and try and see an update on the holdings in real time based on what they reported to Schwab as of January 7th (they’re even more behind).

OK, so, no info at Schwab on SpaceX. How do I know what price I’m “getting” if I buy right now? I know some of the fund is down, I know some of the fund is up. But the market must “know” right? Someone smarter than me must be keeping the price tightly in line based on whatever is going on with this massive 9% of my potential buy?

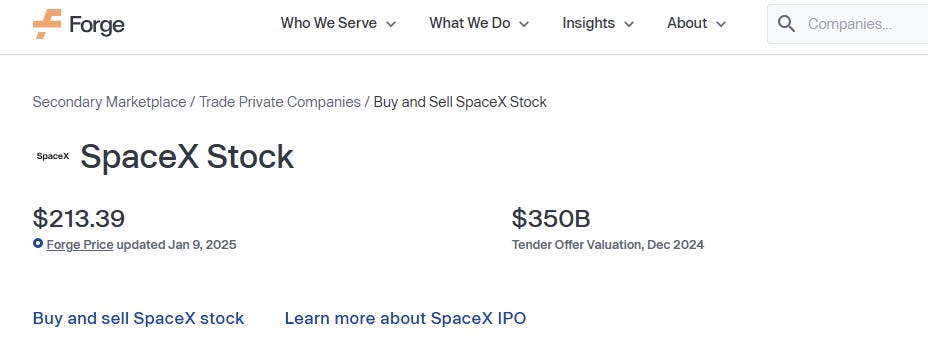

There are plenty of folks out there tracking SpaceX. Let’s get some prices that I, as an individual, can find, right now. First, I called a friend with a Bloomberg, and no, the SpaceX SPV has no info on there at all. So second, let’s check Forge, a site where accredited investors can directly trade privates:

Huh. OK, well, XOVR’s website says SpaceX is worth $185 a share on 1/9, and Forge says it’s worth $213, and Joel said the company was worth $350B, which is obviously from whatever this Tender offer was. Maybe I’m getting a KILLER deal buy buying the ETF when it’s marking the price at the old stale tender price of $185. Let’s look back.

See that giant leap from the $110s to $185? That was the tender that just happened to price right after XOVR bought, which is awesome for folks who got into XOVR then. So am I “getting” 185 if I buy right now? Impossible to know, because I’m just buying from the market. Maybe the market is super smart and pegs the price right to NAV, but even then, which NAV? Nav at SpaceX 185? Or Nav at SpaceX 213?

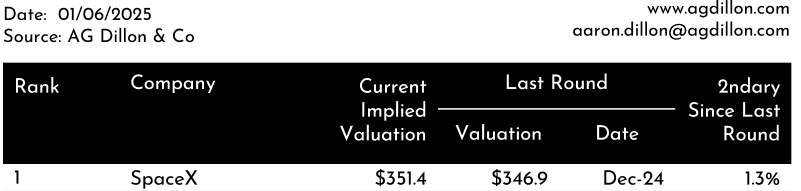

Maybe 213 is a bad price, so lets get a second opinion. AG Dillon is a great firm that helps accredited investors and institutions navigate private markets, what do they say about SpaceX? Well, I can only get an update as of 1/6, but here’s what they said then:

AG Dillon doesn’t really do “share price,” but they conveniently tell you how much things should be up or down in valuation since the last mark. In December … SpaceX bought shares from insiders at $185, and I’m told (but have absolutely no way to confirm or legal recourse to find out since SpaceX doesn’t publish any audited or auditable financial information whatsoever) that means the valuation was $350B. So SpaceX shares, which I expect to own when I buy XOVR, will be worth something like $185, $213 or maybe its $186.40?

The real answer is, of course, any buyer of XOVR will have no idea what price they’re getting SpaceX at unless they pull the portfolio the day after they bought, when XOVR updates its portfolio. Maybe I buy on the day they mark it up to 213 and I’m sad. Maybe they mark it to $150 and I’m happy. Who knows! Isn’t that fun!?

Why This Matters

I’m not saying XOVR is a “bad” fund or that SpaceX is a “bad” company. They are both carefully playing within the painted lines on the field, and like a wide receiver dragging his feet for a long catch, they’re right on the edge. The question is whether you want to be on that edge.

Imagine SpaceX does another offering next week, and it prices at 2X the last price (not remotely a wild idea in these markets). With the stroke of a pen, XOVR would be about 4% in violation of the liquidity rule and have to sell to anyone who would buy. I’m sure there’d be plenty of buyers. Now imagine SpaceX has a catastrophe — it happens, it’s rocket science. How much “should” SpaceX go down? I have no idea. But as an XOVR shareholder, I will just have to accept whatever mark the board decides to give me based on whatever rules they came up with which they won’t tell me.

But even worse: I buy into the fund today and it’s 9% SpaceX. What if everyone else wants in today too, and the fund doubles in size? Maybe the fund can buy another $10m of SpaceX in a hurry, and I’ll still end up with a notional 9% at 4PM. More likely the fund won’t be able to immediately same-day-source more SpaceX shares at a fair price, and my notional exposure to the very thing I wanted is cut in half by newcomers before I even know it — if I ever even notice it. And this is with the fund at $107 million in assets. What happens when this fund is $10 billion in assets? Can they make the same trades when it’s not $10m of SpaceX to move, but $1B?

All of these hairballs: SpaceX lack of transparency and liquidity, XOVR’s lack of transparency in pricing policy, and the impact of flow, are (for now) uniquely problematic to this specific ETF playing this specific game.

How to Fix It

ER Shares has missed a huge opportunity. They spent all this time and money promoting that I could get SpaceX through XOVR, without seemingly investing a dime on transparency. They could publish a formal, legally binding board pricing policy. They could publish board minutes. They could publish trade blotters.

Most importantly, since SpaceX is the “above the headline” marketing message on this fund, they could provide a daily update on the pricing of SpaceX with reasoning. At the moment, I have to guess that the policy is “we don’t bother” because its marked at a month old price that even as a lowly individual I can find plenty of evidence is not the “right” price. Heck, if in fact SpaceX is so uniquely huge and liquid,, they could manufacture an actual price every day by buying or selling 1,000 shares and forcing a counterparty to set the mark. After all, we’ve been told SpaceX has “a highly active secondary market” and is unique for it’s “sheer scale and liquidity in secondary trades”, use it!

They could do, literally, anything that goes beyond saying “get SpaceX in an ETF.”

But they’re not. They’re leaving me to troll the website for updates and pray. Sorry, not good enough for me. If it’s good enough for you, caveat emptor.

I would say the article us pretty spot on - but I think the problems are not unique to buying the etf but are rather just things anyone buying a private investment has to accept

daily pricing? You won’t get it in the private market

Are you getting good value on your private trade? You can’t just look up the bid ask spread on a terminal

Opaque valuations - good luck getting any additional information as a small private investor

Which means the people that are buying the ETF are no worse off than if they bought Space X on the secondary market - whether they should be investing in private equities at all is a different discussion