Why Your Leveraged $MSTR ETF is Sloppy

They're unpredictable, expensive and messy, but other than that ...

Every hardcore day trading junkie wants to trade the shiniest, most volatile, most liquid object on which they can make the fastest of quick bucks, and Levered MSTR seems to be it. Hey, that’s fine. I enjoy a half hour at the craps table too.

But there are very real, structural reasons why anyone investing for more than a day — or even just for a day — are bound to have surprises that make them think the game is rigged.

The game isn’t rigged - it’s just broken by design.

How a Single Stock ETF gets Leverage

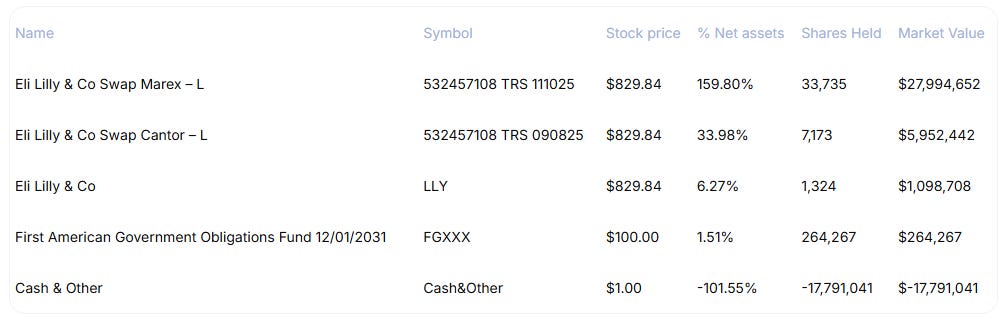

First, here’s how a working fund looks: the Defiance 2X Eli Lilly ETF, LLYX. Here’s what it owns:

First, it owns a little Eli Lilly, because that counts as long. Then it owns two total return swaps - one from Cantor and one from Marex. Those swaps return (one assumes) 2X the return of Lilly every day. It’s a bar bet. Each night, if LLY is up 1%, then Marex “Trues up” the swap and that position is marked up 2%, in Defiance’s favor. If LLY is down 1%, the reverse happens.

From the swap counterparties perspective, they know they have this liability, so what do they do? They immunize it by either buying a bunch of Lilly on their own, or using derivatives to create offsetting exposure. The fund outsources both the leverage and desired beta in one transaction. It’s extremely efficient, and generally speaking the math works: the fund will in fact get the daily 2X return of Lilly, minus whatever fees are embedded (not easily determinable).

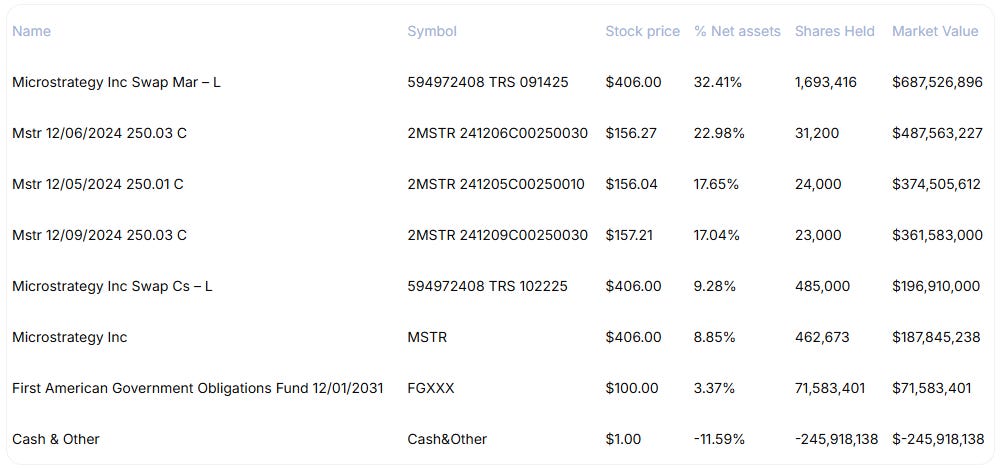

But here’s what MSTX (Defiance Daily Target 2X Long MSTR ETF) owns. Competitor MSTU (T-Rex 2X Long MSTR Daily Target ETF) is similar:

Sure, a there are a few swaps (one from Clear Street, one from Marex), but then a whole giant pile of short-dated deep in the money options. MicroStrategy has become so volatile that none of the big players on Wall Street want to warehouse this kind of risk, so there just isn’t anyone willing to write the swaps in size. The options let the funds get a lot of leverage and maximize the Delta (how much the position will move with the stock), with an attempt to minimize the impact of all those other pesky options hairballs like changes in implied volatility or time-decay.

The Problem, Part 1

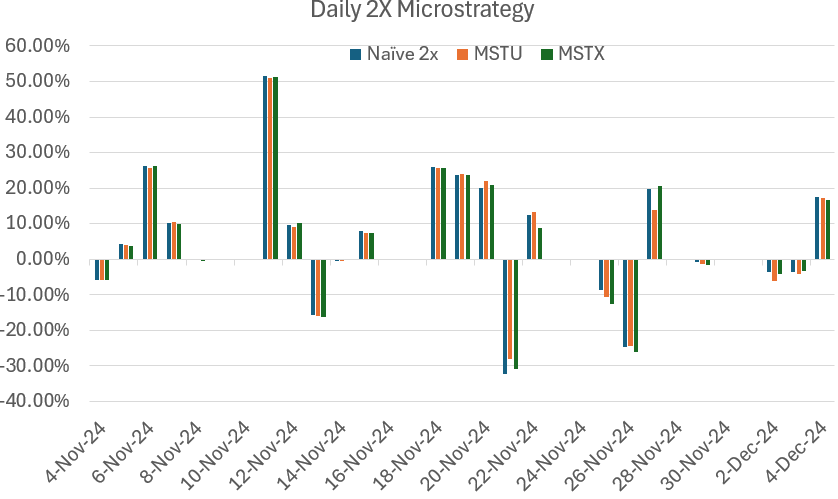

The first problem is that these positions are sloppy. Here’s the daily return of a “naïve” 2X position on MicroStrategy (implying free leverage and no friction), and how the two ETFs, MSTX from Defiance and MSTU from Tuttle, actually performed on an end of day, NAV basis

This looks most fine, except when it doesn’t. Early on here, all is well. But check out Nov 27th. MicroStrategy was up 9.94% that day, so your expected 2X return should be 19.88%. If you were in MSTX, you had a nice upside surprise, because the fund actually returned 20.59% on that day! That’s like more than half a percent of free money, in a day. But if you were the sad pandas in MSTU, you were only up 13.93%! You left almost 6% on the table. IN. ONE. DAY.

That’s a problem. ETFs that try and mimic swaps don’t work reliably. They simply don’t.

The Problem, Part 2

If this wasn’t bad enough, all of these single stock daily reset ETFs have another giant performance issue even if they tracked the Naive exposures absolutely perfectly, and that’s procyclicality.

Any daily reset ETF has to be a buyer on up days, and a seller on down days - it’s never “letting it ride.”

Just think about the promise it makes. If MSTU is worth $100 this morning before the market opens, it needs $200 worth of exposure. If MSTR is up 10% today, than MSTU’s exposure goes to $220 (110% of $200). That means the funds value is it’s initial $100, plus $20 of “winnings” from the overnight bar bet.

So tomorrow, MSTU is worth $120, and thus needs $240 worth of exposure. How does it do that - it buys into the close (or tells the swap counterparty “NEED MOAR”), every time the underlying goes up. On a down day, the same thing happens. (For more info, I wrote about this a lot over at ETF.com)

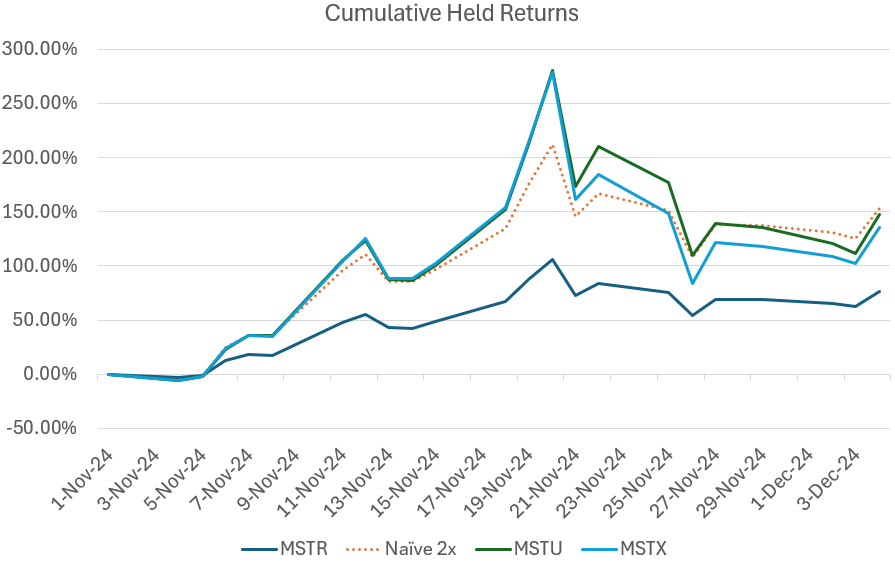

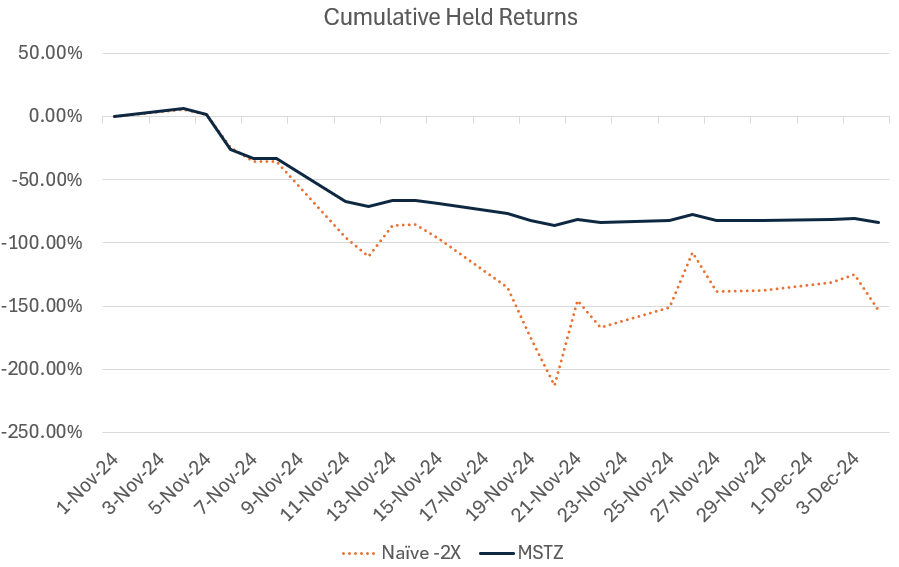

What that means, practically, is if you hold the ETF for more than a day, the rebalancing effects — especially in a volatile market — are wild and unpredictable. So here’s you r actual experience if you’ve held onto these ETFs for the past month and change:

For the full holding period, you “should” be up 153% (2X MicroStrategy’s return). If you held MSTU, you’d be up 148%, and if you held MSTX, you’d be up 135%. This is known as “volatility drag” by those of us who’ve been shaking our heads over it since the GFC. Of course, this works for you if you’re on the other side of the trade. Here’s your experience in MSTZ - the (deep breath) T-Rex 2X Inverse MSTR Daily Target ETF.

Hey that’s good news! You should be down 153%, and you’re only down 84%. You’ve only lost almost all your money!

Not Evil, Just Sloppy

Here’s the thing. These products are actually working as designed — I just don’t think it’s all that useful a design. I don’t dislike RexShares or Defiance — in fact some of my favorite people work at both companies. But ultimately I’ve always tried to write for actual advisors and investors.

Nobody really needs these shiny trading objects. You want more juice in your life? Take up gambling. At least the returns will be more predictable.

Way over MY head.

You know what I'm gonna say... these products also tend to be ridiculously tax inefficient. A completely dumpster versus pure long equity. But lemme crack open the hood and find out for sure...