An Open Letter to Vanguard CEO, Salim Ramji

You've got an incredible opportunity to be less boring

Hey Salim,

We barely know each other. We’ve met a time or two, and had that one coffee in New York this spring where I gave you Zines and I’m pretty sure you thought I was committable. You seemed insanely smart and I got “decent human” vibes. All good.

But I figured what’s facing you as you show up in the Malvern cafeteria is way more than just new-job jitters. You’ve got the chance to do some really important stuff.

As I pointed out a few weeks ago when your competitor Fidelity was making headlines by showing how little they have to care, it’s wild and fascinating that the three biggest movers in the advisor and ETF market — Blackrock, Fidelity & Vanguard— have utterly different business models. Blackrock has to play hardball public capitalist, because they have public shareholders. Fidelity is private, and as said, doesn’t have to care what anyone thinks.

Vanguard, as you know, is different, because y’all are owned by your fund shareholders. It’s not only part of the ethos around Malvern, it’s also your best marketing pitch. It’s plastered all over your website and advertisements.

But here’s the thing: as much as I’m a huge fan of “Bogle’s Hacks” — both retail-indexing and the mutual structure — it’s been years since Vanguard has done anything particularly important with either of them. So here’s what I’d love to see. After all, I hear you’re the man who can convince anyone of anything (and you certainly seemed pre-loaded with Rizz, as the zoomers say.)

#1 With a Bullet: Embrace Transparency

For as much as I love Vanguard (and seriously, big fan, ever since Saint Jack told me it was OK to be boring and forgetful), y’all are the least transparent company in investment management. That’s a bit unfair, since almost everyone else is public, but even Fidelity publishes some version of a financial statement. Vanguard is entirely opaque. Your ads all promise me that there’s value in being an owner. So show me! If I’m the owner, how much am I paying people? How profitable am I and what kind of cash reserves do I have? If Vanguard has a surprisingly good year, will I get a dividend (since I’m an owner?) How do I know the fee reductions over time match the rate of profit growth? How much am I investing in AI, in operational excellence, in training? Heck, what were yesterday’s precise holdings in (pick any ETF?).

I don’t know, because Vanguard won’t tell me. Am I concerned? No, because I’ve seen the firm’s track record of genuinely being on the same side as shareholders, and some of this is in the deepest recesses of your filings and websites, but it’s hardly front and center. The lack of transparency doesn’t make me feel like much of an owner. I get way more intel from my REI membership.

I’m not suggesting anyone’s torturing puppies in the basement or anything, but hey, when you cop an $800k fine from FINRA for getting some pretty basic math wrong last year, I think it’s reasonable — as an owner — to want to know more about everything from granular proxy voting policy to employee retention and data privacy. You did great work at Blackrock on some of these issues (especially around stewardship). Keep it going in the new shop!

#2: Lead the Passive Debate

I, for one, really really hope you don’t steer the big ship towards Crypto, levered funds, hot-dot options strategies and the like. All of those things are great to have in the investment ecosystem, but Vanguard doesn’t so much have “investors” as “participants.” Sure, you have something like 5 million plan participants (a guess, because, see #1) but the core Vanguard ethos is much more about broad, long-term participation in markets, rather than considered risk-allocation in the capital structure (which is what a real investor is doing in capital markets. FWIW I consider myself largely a participant — I’m not engaging in price discovery at the individual security level at all, really).

So embrace that. You have some of the smartest people on the planet working for you. Get them fired up about really understanding the impact passive investing and target date funds have had on market structure and price discovery. Embrace the hard reality that a few things can be true at the same time:

Indexing really is Bogle’s Hack, and the right choice for the vast majority of American’s trying to save for anything. It’s been the right choice. It is still the right choice.

The rampant adoption of Indexing and Target Date Funds has perturbed market structure in ways far too complicated to just “what if” indexing away.

It’s worth understanding these dynamics not to make more money, but to make sure we don’t break capitalism (bad for everyone).

Vanguard could really lead here. You’ve got storied track records in all sorts of strategies, active and passive. Don’t play defense — you’re owned by your shareholders. Play neutral arbiter. Publish facts. Run good academic studies. Host debates. Take the conversation seriously.

#3: Get Clever about Retirees

While you’re embracing problems, how about helping millions of boomers figure out the “now what.”

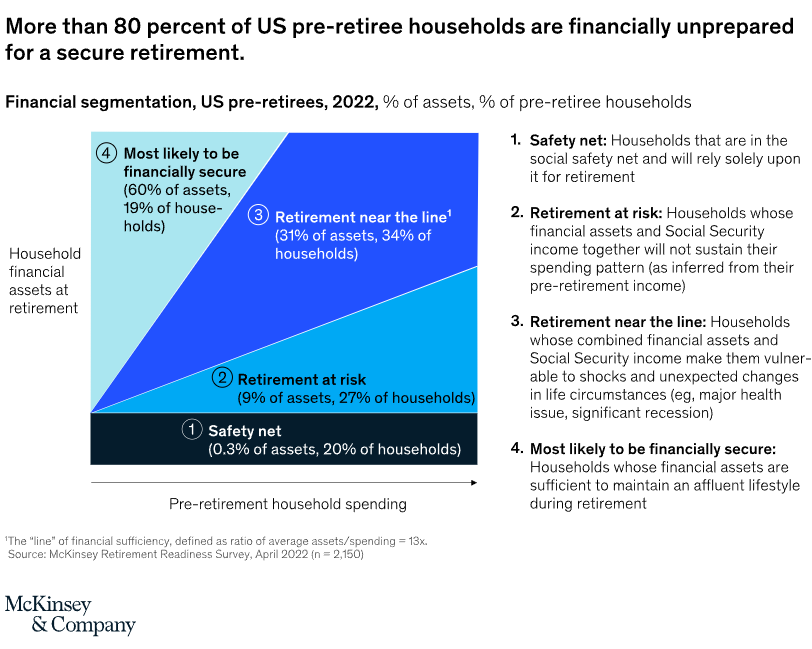

The majority of folks retiring from this point on are, in some way or another, screwed. Not enough saved, a failing social safety net, and no real way to manage their way from retirement to the grave with dignity. It’s a genuine crisis of generational risk.

You know how you solve giant population-level risks like this? Pooling. Insurance and risk-pooling are, because of how incredibly stupid the U.S. financial services regulatory environment is, the third rail of “serious” finance discussions. Outside of TIAA/CREF and some Canadian products, essentially nobody is working on actually risk-pooling retirement assets at scale in the only way it makes sense — which is in a Tontine (*cough*, I’m sorry, perhaps we have to call that “pooled longevity insurance” or something.)

Right now, the wildly misaligned incentives and byzantine 50-state regulatory environment make it impossible to do this correctly for most of the U.S. population.

But Vanguard is already a mutual company. I’m not suggesting you stand up 50 state-level insurers, but I am suggesting you have the heft and the structure to beat up Washington on this issue forever. And I wouldn’t be surprised if you could figure it out even under the existing constraints.

… and so …

You’re very smart. You have very smart people. You now run a trusted hyper-agent, who can have some influence on the rather wild set of rules we’ve all agreed to use to play “Capitalism(tm),” — a collective dream we all wake up every morning and keep propagating.

I hope you crush it.

Great piece, Dave. Having been a Vanguard client for almost 50 years and encountered their talented employees in my professional roles, I agree this is an amazing sandbox for Salim to play in, lead, and organize. I would support your idea that they should lead the passive/active debate but also use their platform to promote education of investors and regulators of the implications of growth of assets in large scale, structured fund strategies. Mostly this brings benefits (cost, better product choice, transparency), but the implications for market dynamics, shareholder governance etc. are more complex. Look forward to seeing how he carries on Jack Bogle’s legacy.

Love this