Bitcoin Endgames & The New Hyperagents

If the HODLers are right, they're also the new Elites

This is not a post about whether bitcoin will go up or down.

This is not a post about whether bitcoin “works” or not.

I will beg, constant reader, that you grant me some basic bona fides in the crypto space. I have read all of the original foundational documents and most of the additional information that has come out in things like the no-Wright-isn’t-Satoshi trial. I have run Bitcoin and Ethereum nodes, written smart contracts, minted and purchased NFTs, traded various silly alt-coins, and played around with both US and internationally-based DeFi protocols (before FTX blew most of the fun ones up). Heck, as far as I know I’m the only one teasing out 10bps ineffeciencies in the ETFs.

Assume “I Get It.” As always, my big questions are about the “… and thus” of it all.

#Winning

$11 billion in new flows, to an AUM pushing $30b in two months. That’s a lot eh? Following the daily flows and trading in the 10 products is now a cottage industry. Folks like Scott Melker (who writes the best crypto Substack, The Wolf Den) have spent the last 4 years getting very smart about ETFs to match their smarts on Crypto. Meanwhile, folks like Bloomberg have gotten very smart about Crypto.

BTC market cap is about $1.5 Trillion, vs about $45T for the S&P 500, or $50T for the U.S. bond market, or $120T for commodities, of which about $13T is gold. This makes Bitcoin absolutely a meaningful asset class, and the ETFs have worked, essentially, perfectly, despite me spending a month trying to find cracks in the sidewalk.

So, mission accomplished. Price will go up. Price will go down. Now what?

Psychological Commodities

The challenge in figuring out “what comes next” is that bitcoin doesn't exist.

Bitcoin is, of course, a digital fiction created in code and is currently the most valuable psych experiment in the world. Bitcoin, like Gold, is fundamentally a psychological commodity. Psychological commodities are extremely cool and there are surprisingly few of them.

A psychological commodity is an asset whose value is solely and completely determined by others’ willingness to pay a specific price. Most luxury and intangible values are inherently bolstered by their status as psychological commodities: Louis XIII doesn’t affect the human body differently than cooking wine, and “goodwill” is greatest the accounting slop-bucket of all time.

This is cool! After all, in a very real sense anything we ascribe value to above the bottom of Maslow's hierarchy of needs is largely a collective fiction we all agree on.

We, people of the planet, have decided on a ruleset to manage planetary resources. We tend to forget this most of time, until the rules get broken: Russia just decides it wants to own Ukraine again. Then a whole other set of rules we may or may not choose to follow – those covering international conflict - come in to play.

Ordered society is fundamentally based on these psychological fictions, so I actually think it's very cool that certain clearly non-utile assets, like art, or Bitcoin, or Gold, have been ascribed value. Think how monochromatic the world would be if it were any other way!

So calling bitcoin a psychological commodity is in no way a diss. But it is true. There is no floor bitcoin based on some rational Book value, nor is there some Ceiling other than global economic domination. Bitcoin’s dollar-value (or euro-value, or oil-value) at any level requires that there are others willing to exchange at that value, period.

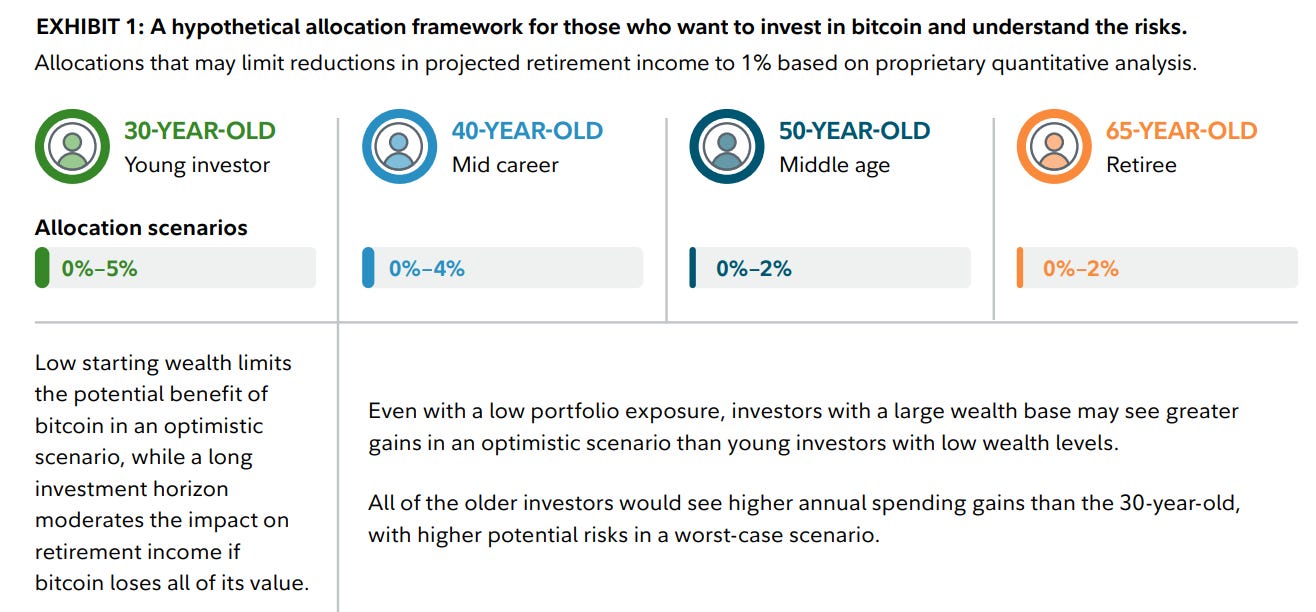

How then, do we deal with this next phase of the Bitcoin story, where every asset manager is now promoting it as a portfolio asset in some version of this chart (from Fidelity):

As I see it they are basically two end states for bitcoin.

The Bullest Case for BTC is Awful for Humanity

If one version of the techno-optimist/Fiat-is-a-crime/taxation-is-theft maxi-credo is right, then global fiat-based economic systems will spiral into a cycle of inflation and bad policy that is net-impoverishing and rife with social unrest. Those who put power-reserves (i.e. - excess capital) outside that system are metaphorically moving their chests full of shiny rocks to some island to wait out the chaos. In even a middling version of this scenario (which plenty are arguing is the now), then there is a massive wealth transfer

FROM:

the late-and-slow large pools of Fiat in the world (mostly the assets of governments {those would be *our* assets} and massive institutions).

TO:

crypto enthusiasts who got in early enough.

12 years ago an analyst on the team (who I will call Bob) had pocketed a handful of BTC at movie ticket prices. Assuming that they HODLd, they are now on paper worth $1 million where before they were worth nothing. That million dollars “came from” people who just bought in at $72,000 — because that’s what sets a price: a recent transaction on the tape. If they liquidate back to dollars, Bob’s windfall is a very real and tangible transfer of power.

But importantly for Bob to DO anything with that power — buy a car, donate to a politician, feed the homeless — they need to sell some bitcoin get something that will be used for a medium of exchange – the dollar (or whatever). So unless the ONLY thing Bob cares about, for the rest of their lives, is accumulation of value in a ledger, someday they have to sell some to gain real-world power, or a Lamborghini.

Who’s buying so Bob gets his Lambo or Politician? Folks who are now just jumping on the bandwagon in ETFs. Whether those people are "greater fools” I will let you decide.

Moving back to 30,000 feet: this is a transfer of economic power from two classes: slow hyperagents - those who currently bend the global ruleset around them, and average joes now “participating” because folks like Fido are nudging. That power is transferred to a new class - early crypto natives. Early crypto natives become the new “elite,” who, on moving back into the fiat world, arrive with the pocketbooks to be hyperagents, dominating politics, dictating policy and accelerating the slide into corporate oligopoly.

In this “hard money wins” world, the suffering implied for the rest of humanity — those folks who basically work for a wage, pay taxes, and spend most of what they earn — is immense. It is, frankly, Argentina on a bad day for most of us.

The Bubble Case isn’t Great

So what's the second possible outcome? The naive and hopeful getting rugged.

Captured in a single number — the price of Bitcoin — are all the hopes and dreams of the original techno-utopians, the HODLing Maxis, the late-coming day traders, the longterm institutional allocators, and the random car wash attendant who took a flier in is IRA hoping to get lucky.

I suspect, based on anecdote, that many, many folks buying a BTC ETF right now aren’t deeply versed in either power-theory economics or blockchain technology. They see a number that's going up, and it feels like FOMO not to participate. After all these tens of billions of dollars can't all be wrong! Right?

Some of those folks are making considered asset allocation decisions. Firms like Bitwise have done genuinely great work explaining Bitcoin-as-portfolio-asset. It's not insane for somebody building a long-term global portfolio to think about having a one percent allocation just to be fully exposed.

But to some extent, like Gold, price is game of global chicken, where the true wealth of the world –the 1% of that owns 50% all assets, and 63% of all new wealth creation —has to decide where to park that power. Are they waiting for the collapse of society? If you bought at $10,000 are you really going to hold on to your position unrealized at at $100,000, or will you start moving some of that money back into the Fiat currency system, and back into traditional assets, using greater fools to increase your power allocation in the global economic sphere.

In this scenario, bubble psychology reigns, and while seasoned crypto HODLers will HODL, it’s the tourists who end up buying at the top and puking at the bottom. Some of the power transfer will come from the current Fiat-elites, but a lot of it will come from average folks who thought they were getting a ride alongside the smart money.

Gambling is the rational response of the dispossessed. That’s the shorthand for Epsilon Theory’s Financial Nihilism analysis. We would do well to remember that most reddit posts that start like this…

…end like this…

The crypto-natives won’t accumulate ALL the power they would in the bull case — just a lot of it — and the human suffering will be just as real, but more localized.

Both Outcomes Result in Power Transfer

Both of those scenarios lead to a transfer of power from one class of citizen to another. And this isn’t unknown by the current hyper-agents and thats the reason you see vacillation by everyone from Jim Cramer to Jamie Dimon: a few tens of billions of dollars in Bitcoin ETFs makes people notice, and they are getting nervous. They don’t want to lose their stored power.

In either BTC $10k or BTC $1M, this power transfer occurs. Obviously the higher the number goes, the more existing stored power has decided to shift off to the island and wait out the storm. But the power shifts even so — that’s why Mike Saylor is doing everything he can to borrow dollars and buy BTC. Whether you ride out systemic collapse in BTC, or are just waiting to fleece the noobs, both are are power collection modes, just of different kinds: Sell now and wait to buy lower, or hang on for the coming apocalypse.

Does it matter?

Whichever version of power transfer we get, there are things to watch.

On the one hand the current hyper-agents (corporate oligarchs, elite politicians, media manipulators) are all, taken together, pretty awful, and regulatory capture is already nearly 100% (and getting stronger with each APA case). Once those folks get truly nervous, they move more power onto the island, ballooning value even more. After all, it apparently only took a phone call or two to flip Donald Trump on TikTok.

But late is still late, so I can imagine a world where we (the big We) essentially give a ton of power to the crypto early adopters and techno-Utopians because how much worse can they be?

What does the world look like if bitcoin is at $1 million?

Option A: Mike Saylor and his ilk get enormous influence over everything from how US corporations run, to who’s in charge in Washington. Perhaps that’s enough, and the state isn’t eroded into anarchy, merely placed under new management.

Option B: Accelerated corporate oligopoly, where the state fights a losing retreat into a smaller corner of public life, while housing, health, safety nets, social interactions and access to technology is gated by your employer.

Option C: The Empire Strikes Back, and all those lunatics who are worried about a future “Bitcoin Reserve Act” get a lot of airtime as the U.S. backs Bitcoin into a corner through hamhanded regulation and taxation (the favorite cudgel of policy) or ownership curbs. This becomes less likely every time BTC makes a new high, and certainly seems impossible in a post spot-ETF world, but hey, a lot of stranger things have happened in the last 5 years.

(Since I claim to be a financial futurist, I will tell you I think the middle of the bell curve is Option B — because that’s the ski-slope we currently seem to be running down, and it doesn’t require BTC to hit $1 million, just to continue the run.)

Number Go Up!?

If that all sounds like one giant case for “number go up” I can’t much disagree (and short term the mechanics are hard to argue with), but most of the planet hasn’t been playing this game.

Sure, the Maxi’s can use this as an excuse to say “have fun staying poor” - a phrase that immediately signals “Inhuman Coprophiliac” when it hits my ears, inevitably pointing to someone who has all empathy and clearly never ever actually had human contact (or concern) with “the poor” in any capacity other than avoidance or guilt donations for tax write-offs.

But most humans on the planet do not have enough capital to participate in this bonfire in celebration of the fall of empire. Those that do, if they’re right, end up in charge.

And what of our new overlords?

I’m skeptical that the lessons learned in the hyper-tribal, HODL, laser-eyes coinpumper community that has weathered countless winters are applicable to say, sound agricultural policy, or rebuilding the U.S. insurance system.

What lessons will they have learned, reinforced by the dopamine hit of having “been right”? That cult-like tribal dedication is rewarded? That everything in life can be divided into YOLO and HODL? That all that matters is how big a bag you can stash? That rules are for suckers?

That betting on the collapse of the now is a better use of their time and treasure than building or fixing the future?

None of this is new. From the Teapot Dome to the Robber Barons of Twain’s Gilded Age, we've seen the story before: economic power drives a new group of hyperagents to rise to replace the old. They found the new institutions, and make the new rules. That’s what hyperagents do, from the founding fathers to Elon Musk.

And this is not a conversation I’m just inventing. With the decline of twitter most interesting conversations have gone into private slacks, discords and whatsapp groups, it seems, but my friend Adam Butler agreed to let me post his contribution to a recent discussion:

Adam’s positions here is more extreme than mine, but not un-representative of a section of finance, I find: full acknowledging the possibility that all the crypto bull arguments are valid from a number-go-up perspective, but unsettled by the implications for society.

There are of course plenty of examples of individual human beings who have made a lot of money in the Crypto ecosystem by building things and then doing quite noble things with their new power: Vitalik Buterin comes to mind. But we honeslty don’t have a clue who will be the ultimate winners. Supposedly the Satoshi wallets are sitting on a cool $70 billion or so. Even at todays prices, that’s hyperagency money.

Could it all come crashing down tomorrow? Of course. But if it doesn’t, my prayer is for these new landlords of our future: May you find meaning, sympathetic joy, and above all else, wisdom.

-

[Disclosure: Personally, I can’t bring myself to bet on the collapse of Western Democratic Capitalism. I don’t judge those who go all in, but I’m not short any asset, much less my country. It’s just not a choice that aligns with my ethics, thus my BTC exposure is negligible. I have more money in Bicycles than Bitcoin or Gold.]

Interesting piece, Dave. But, you left out the optimistic vision entirely!

Societies run generally better on fiat systems; the economic data is fairly clear on that. In an average year, fiat economies have slightly higher growth and significantly less volatility than hard money economies, including less volatility in inflation (something hard money advocates rarely recognize).

But the flaw in fiat systems is that they historically end in disastrous failure. They are great, great, great, great, great, and then absolutely spectacularly bad. The flexibility they offer is valuable and helpful during economic volatility, but they are too tempting to abuse, so they end in runaway inflation and debt crises. The US hasn't had one in a while, but people are worried we're getting there, what with the limitless explosion of debt, rising political volatility, the weaponization of fiscal/trade/payments policy, and the disastrous state of DC. And those end-state catastrophes are terrible for people, both short-term and long-term.

If bitcoin grows large enough to offer a viable alternative to the fiat system, by way of its existence, it could create a natural curb on the excesses of fiat abuse. Right now -- particularly in the US -- there is no real force for restraint on fiat abuse because there is no viable alternative. So we trip along slowly ... or, recently, quickly ... until it's too late. A robust alternative might constrain the US from being too egregious in its monetary and fiscal policies and, as such, allow society to reap the benefits of having a flexible fiat system without us ever stepping over into the abuse-failure case. And if we still can't resist the temptation to abuse the fiat system, well then, at least we have an alternative.

I don't disagree with anything you say, yet I can't bring myself to completely discount the idea that some not-insubstantial fraction of bitcoin millionaires/billionaires are quietly putting their thumb on the scales with politicians and governments and quietly funding save-the-planet type ventures. Their silence may be because 1) crypto money may still have some stigma associated with it, 2) many big philanthropists/planet-savers prefer to be anonymous rather than show off how charitable they are., or 3) some combo of both. IDK how much scale tipping they're actually doing, versus buying lambos and so forth. All I know is that the biggest, most influential money usually talks only in whispers.