The ETF Innovation Black Hole

Share Classes? 401ks? AltCoin ETFs? Sorry folks ...

Welcome to regulatory stagnation: ETF Industry style.

Earlier this year I gave some predictions for 2024’s ETF stories, so let’s check in.

First, some context:

For most of my adult life, I’ve played in the ETF sandbox because it’s been the most interesting game in town: the maximally efficient encapsulation of market capitalism. Everything interesting in investing has run through the ETF infrastructure for the past 30 years.

Except, not so much anymore. For all the GenX whining about “late-stage capitalism” it is in fact true: we are at the Zeno’s paradox vanishing point for packaging risk in ever narrower and liquidity-defying containers, and the current regulatory (and let’s be really really clear, legislative) environment is such that nothing novel, innovative or even interesting is going to happen for at least a little while.

Let’s run through some of hot-button areas dominating the agendas of ETF conferences and YouTube conversations.

The Share Class Trap

If there’s one big hanging chad in ETF regulation right now, it’s the issue of Vanguard’s now expired share-class patent. Pretty much half the industry has now filed for some version of “let me make ETFs out of my Mutual Funds” or “Let me make a Mutual Funds out of my ETFs” share class approval. CBOE has the only timed filing out there, with a 19b4 that seeks to list ETF-share-classes. It’s a bit of an open issue about whether this would even be required, although should they get approved, they’ll have a faster-track towards getting some new ETF share classes trading (through new generic listing standards).

The important bit, however, is that 19b4s are one of the *only* SEC filings where the deadlines and dates actually mean anything. The SEC actually has to respond to CBOE by December 11th (if I have my math right). Theoretically, if they *don’t* the rule becomes effective, although a pocket veto seems extremely unlikely.

Between now and then, my survey of lawyers and insiders show mixed opinion, but the smartest and most connected folks I know believe absolutely nothing happens until the CBOE filing is dealt with, and even then, I’m left with extreme skepticism the SEC allows anything novel or innovative to happen on their watch without another APA lawsuit.

I’m not suggesting they have any good reason to deny the filings: “You let Vanguard do it” is a very good argument. But lets remember the whole reason the SEC is concerned about a blanket approval — they’re worried about conflicts of interest and cross-class subsidization. They’re worried that (say) a fund having a bunch of different share classes with different fee structures creates the potential that one class might benefit the firm more than others, or might lead to investor confusion and differential incentives that put one class of investor ahead of another in some way. And yes, they’re worried that having one share class (the ETF share class) wash out capital gains for the whole pool of assets (as it has with Vanguard) through heartbeat trades while other share classes “free ride” on the ETF creation/redemption process creates disparate treatment.

These are completely reasonable concerns. I’m not saying they are accurate concerns — I think it’s hard to show the harm to ETF shareholders, for instance, if they engage in “excessive” heartbeat trades designed just to run decades worth of embedded gains through the scrubber. But they are not irrational concerns.

It’s not clear that the IRS could just change the playing field - the tax treatment of in-kind transfers is hardly a new thing, and plenty of tax attorneys have been recommending changes (and ensuring their unemployment in finance) for years. Every so often a big paper title like this one gets things stirred up

But then something shiny happens and we forget about it entirely. You know what will make the IRS *not* forget about it? Suing the SEC over how unfair it is that your ETF company can’t play Vanguard’s game. It likely takes more than just a smart IRS employee. It probable takes congress. But that’s not off the table at all.

Senator Wyden failed in his hamhanded attempt to remove:

“Section 311(b) shall not apply to any distribution by a regulated investment company to which this part applies, if such distribution is in redemption of its stock upon the demand of the shareholder.”

from the code in 2021 but I wouldn’t bet on that lasting forever.

Given a choice between keeping the code intact, or opening up the share class floodgate, I know which door I’d pick.

Square-Peg 401ks

I was pretty negative on ETFs and 401k plans and I still am, but that won’t keep the industry from trying. While I may think there’s just no reason nor enough demand to crack the 401k market open to ETFs (CITs are a better fit in every regard, IMHO), I could absolutely be wrong. The most interesting way would be for Anna Paglia (New head of SSGA, and I’m a big fan), to make good on her promise to Bloomberg a few weeks ago.

“ETFs, just like mutual funds, are used in other parts of the retirement industry — for example, IRAs — and we are really working to build that ecosystem where ETFs can find their way into 401(k) plans as well.” - Anna Paglia to Bloomberg

I remain skeptical as heck, SSGA has some incredible strengths, some great people and some real challenges even before they tackle the difficulty of cracking open the defined contribution market. But I also have a hard time betting against Anna Paglia.

Pay-to-Play

I predicted we’d be talking about it, and lo and behold, Fidelity decided to hand me an early win. It only took till April for them to announce a $100 penalty box fee (no, no, of course it’s not a commission!) Since then, the June 3rd deadline originally mentioned has passed, and as of this morning, I couldn’t get my Fidelity account to show any additional fees on edge-case issuers like Day Hagen or Cambiar.

Instead, literally every single issuer I have talked to has done one of three things:

Come to an agreement on a revenue share of something between 10 and 20% of the revenue attributable to their ETFs held at Fidelity.

Is negotiating with Fidelity, but feel like things are taking forever.

Have ignored Fidelity, and have received no more useful communication on the topic.

In other words, the initial press release has had the mostly desired effect of bringing more issuers into the gaping maw of Fidelity’s revenue demands, and it remains to be seen whether the recalcitrant will actually get charged the fees (if someone has actually SEEN the fee, I’d love to see your trade confirm!)

While a little handwringing happened in the press, honestly the whole kerfuffle is just showing up in retail, in one of the clearest examples of how long it takes inside-baseball to become nightly news, Kiplinger’s’ seems to have just heard about it:

What next? More of the same. Revenue share isn’t going anywhere.

Crypto! (or, Bitcoin™!)

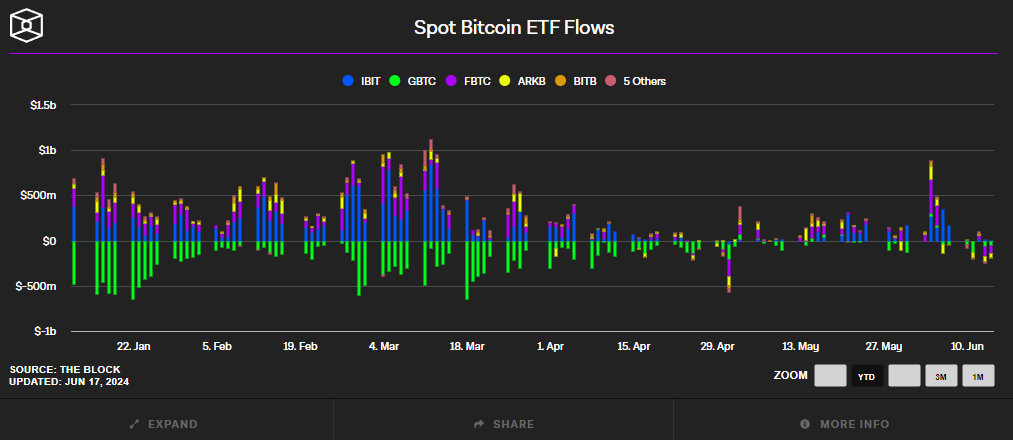

So what has been the BIG INNOVATION of 2024? It’s hard not to say the launch and buzz around Crypto ETFs, specifically the actual launches of the Bitcoin ETFs. And hey, it was a success right?

Lots of flows, lots of volume, the total complex now sits on some $60 billion of bitcoin, or around 4% of the Bitcoin in the world. Next up is the ETH ETFs, which, given that they follow most of the same storyline as Bitcoin ETFs, seem likely to be approved and start trading sometime this summer.

So that means we’re entering a new era of Crypto innovation right?

Wrong.

Unfortunately, I think we - as in America, and largely Western Democratic Capitalism - has already blown it. We had the chance to set up a next-generation financial system that worked with and alongside the needs of governments, corporations, banks and humans. Instead we’ve been backed into a corner of allowing a set of speculation vehicles to bridge into crypto (the ETFs) — and that’s it.

Fundamentally, little has changed other than a whole lotta people can now bet on number-go-up more easily. We haven’t changed the rules about how crypto works. We haven’t written smart legislation on how smart contracts mesh into the legal system. We haven’t established rules for bringing traditional assets on chain. We’ve mostly been caught in squabbles over what people have already done wrong under the old rules, rather than trying to build something new.

As my friend Ben Hunt has been pointing out for years now:

In my dystopian vision, Bitcoin isn’t banned or criminalized. Pfft. That’s a rookie, weak State move. No, I see a future where everyone buys Bitcoin. Where you are encouraged to buy Bitcoin. Where Bitcoin is sold to you morning, noon and night. Where normie economists get on conference calls late at night because they’re Bitcoin price-curious.

Except it’s not really Bitcoin.

Instead, it’s Bitcoin! TM — a cartoon version of the OG Bitcoin, either a Wall Street-abstracted representation of the price of Bitcoin or a government-painted version of Bitcoin in Dayglo orange. Either way — abstracted or painted — your Bitcoin! TM is trackable and traceable, fully KYC and AML and FBAR and SWIFT and every other US Treasury acronym-compliant. Either way, your Bitcoin! TM has all the revolutionary potential of a bumper sticker and all the identity signaling power of a small tattoo on your upper arm.

Bitcoin! TM doesn’t stick it to the Man … Bitcoin! TM IS the Man.

So yes, we have Bitcoin ETFs and we’ll have ETH ETFs… and that’s precisely where I suspect the innovation stops. A Gensler-led SEC has zero interest in leaning into innovation, and while a post-Gensler SEC led by someone like Hester Pierce could be very pro-innovation, I wouldn’t count on it. Not until we get functioning executive and legislative branches at the same time, which, if I’m making a prediction, isn’t happening in any timeline in the next 5 years.

But … But …

Look, there’s plenty of actual innovation left in the old ETF bones. I just think the era of structural innovation is coming to a long slow end, and likely doesn’t pick back up again until we create a framework for tokenization of all different kinds of assets (especially corporate equity).

Who’s innovating? All the folks packaging trades and portfolios. Folks like Newfound are helping solve actual portfolio problems with their Return Stacking suite. Roundhill seems to be a bottomless pit of wild new exposures (Inverse Mag7 anyone?. Alpha Architect keeps pushing the envelope on quant trades. YieldMax seems like it’ll make an income strategy out of almost anything.

Innovation is still happening inside the four walls of the established ETF ecosystem. But the structure itself?

Late-Stage.

Innovation from these well traveled roads might be dying, but the thing about innovation is that it's fluid, and usually pops up from pockets that have been forgotten or ignored.

One thing that this post highlights, that until now I havent been able to articulate, as far as innovation goes, it is getting very hard to separate "ETFs" from asset management generally. A few years ago I would have said there is a clear distinction. Not anymore.

Great read Mr. Nadig. My hope is that investment product innovation will prevail, regardless of the wrapper.