Here’s my TL;DR on the state of markets, and the state of ETFs.

You are on your own. There are few left to trust.

The CorpoState

I genuinely try to project joy, positivity and optimism as much as I can. I have tried to be a white hat. Being a champion of low-cost indexing, the advantages of ETFs, the value of rational decision making has been easy, accurate, and if I do say so, probably the “right” thing. Sure, the rise of passive has had real impacts, but mostly, It’s been a white hat ride. One that felt at home with my white hat worldview.

The world has changed. You know this. You might be cheering for it. But it’s still changed.

Being “American” no longer means white hat on the global stage. I’m not dissing America. I’m deeply patriotic. I have had the Pledge of Allegiance framed and hanging in my house my entire adult life. But the Flag I pledge to is of a country that at least pretended to be a white hat in gray world. A superhero. As my friend Ben Hunt wrote so brutally this week:

I see what’s happening today — that the United States is a Great Power but not a Good Power, that the American State and the American Oligarchy are now unified as one in the pursuit of power for power’s sake, that this union leads inexorably towards an illiberal, totalitarian society — as clearly as I’ve ever seen anything in my life.

America — and to be clear, that also means our economy and markets — are now headed into the ravine that is the great unwinding of “America” into “American Oligarchy.” We are on an inexorable path towards the CorpoState: A state run by, and primarily serving the needs of Corporations, not people. In other words, America is now a black-hat actor on the world stage. That’s my real, thoughtfully, carefully considered, non-reactive, party-unaffiliated opinion. You’re welcome to your own.

Never Bet Against the House

While I am sad, numbers go up.

Black Hat America will continue to house many of the worlds most important corporations, and indeed, the dismantling of the state will inevitably result in their enrichment. There is still work to be done, and when the state no longer directly does the work, what’s left but private prisons, private space, private entitlement administration, private disaster relief, private safety nets, private armies, private education and private food safety regimes?

The chaos will be real, and markets will eventually have some spasms to reshuffle the winners and losers, but the end-state … which is not far off … is pure cyberpunk-level corporate statehood.

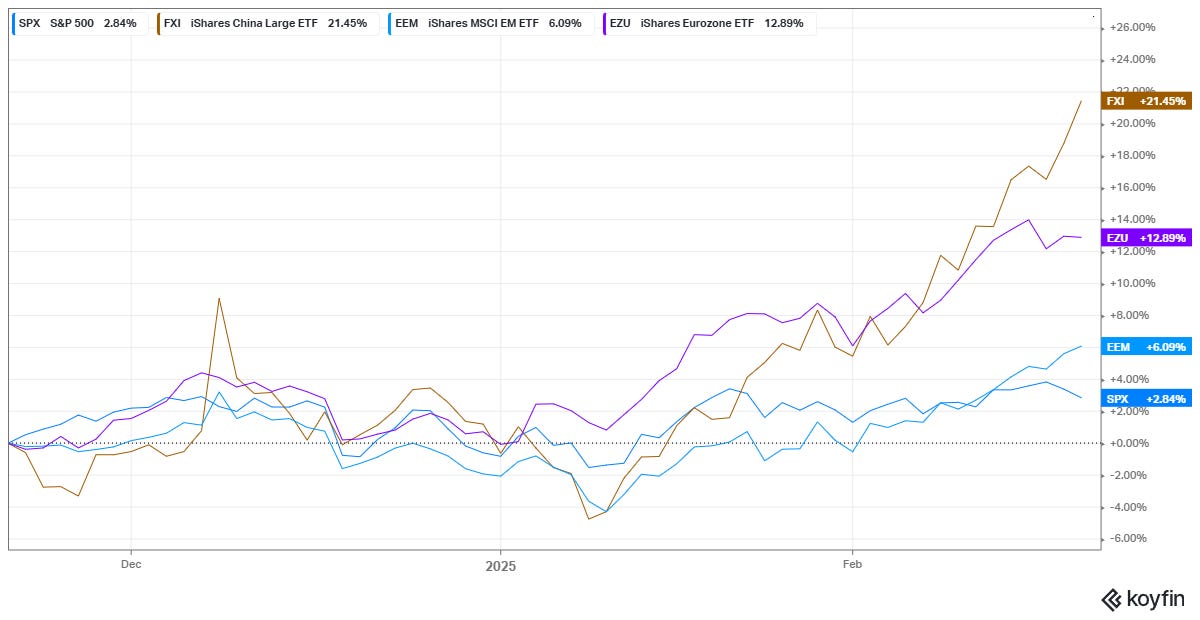

At the same time, the international reshuffling is happening in real time. It’s not just a weird accident that in the last three months, the US equities are lagging Europe, China and Emerging Markets.

America may seem stupid right now, but capital is smart, and capital understands what’s going on. We’ve taken off the white hat. You can handwave off the very real data that suggest our former allies now see us at best as necessary partners and at worst as actual adversaries, but the cold hard truth is that the Chinese Belt and Road initiative is now the dominant global development program, and an entire generation of emerging markets citizens has learned — nearly overnight — who is a reliable friend, and who is a capricious one. Most advisors I’ve talked to are feeling pretty good about their boring old global multi-asset portfolios.

This American retreat applies to you, investor, in other ways beyond your global asset allocation.

While financial regulators will likely be left largely alone on paper, what gets enforced and who gets prosecuted is up for grabs. The coming lack of (or clearly rigged) oversight and enforcement of basic rules and laws we’ve counted on in markets for decades means you need to be much much more careful in picking your “trusted partners” then ever before.

Put another way: if you buy something and something bad happens, you will simply have lost, or will have to mount your own lawsuits. Nobody cares about “brand damage” or “reputational loss” anymore. Those are quaint notions from a time when companies actually stuck to their guns when the wind changed. Very, very few companies in your investment chain are proudly claiming the white hat anymore.

The Black Hat ETF Market.

As we gut social safety nets and re-localize services, financial nihilism will continue it’s Icarian rise as self-directed investors with small bags of money are targeted by the most aggressive products.

Nearly every product launched in the last year (and most of what’s in filing) falls into one of a few categories that are not “cheap beta” or “portfolio building block.” A lot of what’s being called “innovation” is awful for anyone but a literal day-trader. Most of it is firmly black hat.

Liquidity Laundering

There is interest in things like private equity. However, most advisors I’ve talked to who are genuinely interested already offer their clients access through all sorts of non-ETF means, like actual P/E tranches, their own pools, interval funds, CEFs, etc.

At the same time, literally nobody I’ve talked to is interested in is being “sold” the dregs the institutional bacchanal. Products like ERShares XOVR explode the very idea of “transparency” that used to be a key feature for all ETFs, and every step into private securities it’s only going to make it worse.

But make no mistake - Black Hat marketers will push these products to market. It seems literally-inconceivable to me that the first-filed SSGA/Apollo Sole-Source, captive-market ETF is approved for very real structural reasons, but they’ve been extending the filing only a few weeks at a time, with, supposedly, February 28th as the next effective date. With the current administration littered with private equity millionaires, there’s zero chance of any actual resistance, regardless of risks. Private market folks need to offload their worst stuff into retail. (Go ahead and try to convince me their BEST opportunities, pricing and access will end up in a retail ETF, I’m all ears). This is pure black hat stuff.

The White Hat Approach? If you’re an issuer, and you’re basically forced to play this game, every dollar you spend on marketing will have to be matched with 10 dollars spend on actual education and transparency. Every aspect of how you buy, sell, and more importantly value each private holdings is key. And for the love of all that is holy, if you can’t meet a 50% redemption day without shuttering your fund, you don’t belong in an ETF. You belong in an interval or tender-offer fund.

Derivatives, but for nOObs

There are now a half dozen or so interesting ways to mold your market returns in subtle, efficient, and decidedly white hat ways. From the capital efficiency/portable alpha Return Stacking tools from Resolve and Newfound, to downside protected China tech, to plain-old diversified equity income strategies, there are very real use cases for ETFs that make relatively simple options-oriented strategies available in good, cheap packages. Advisors do use these kinds of products, but they’re not morons. They look at price. They look (hard) at pedigree. Here, if you’re not Innovator, FT/Vest, one of the top 5 issuers, or named “Corey Hoffstein” you’re probably way too late to play, unless you own your audience.

This white hat problem is largely one of differentiation. Why should an advisor trust your product vs. someone else’s? Especially in a market where there are now hundreds and hundreds of clearly black hat products promising the moon. Communication is again key here — especially if markets move a lot — but tools are probably most important. Firms like Innovator have leaned in hard here, and that creates both a point of sale differentiator and a reasonable moat. You need to teach people not just what these products are, but how to use them.

Derivatives, but for Chaos Goblins

Whether it’s single stock ETFs with leverage or long-short funds or seemingly impossible yields, there’s a LOT of this stuff on the market, and the “hot sauce” as Eric Balchunas calls it, dominates the launches over the past year. Most of these funds do exactly what they say do on the label, but what they say on the label tends to be extremely difficult to actually understand or predict, and honestly most long term investors and advisors should pretend they can’t read and run the other direction.

The fact that I personally think almost every product in these buckets is genuinely black hat is irrelevant: they sell like hotcakes because retail gamblers with smartphone apps are addicted to the dopamine hit. These products are just TikTok content for success-porn addicts, and make no mistake, the black hat issuers (and especially their trading counterparties) are making swimming pools full of money on the back end.

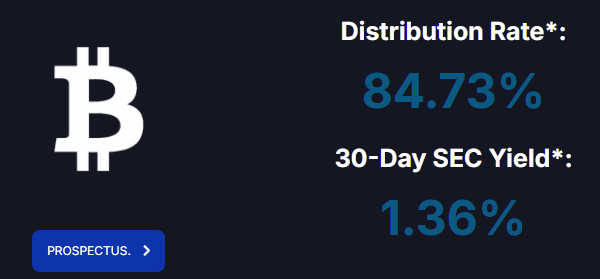

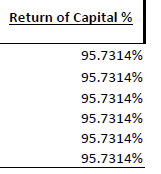

If you’re an issuer in this space trying to actually do the right thing, what you tell investors — right when they hit your website from a google search — really, really matters because you and I both know nobody is going to read the PDFs linked 3 pages deep on the website. I would argue there is a very real difference between this landing page (YieldMax)

and this one (Direxion):

Especially when said YieldMax ETF is actually just continuously giving you your own money back:

Black Hat? Letter of the law, investor outcomes be damned. Gray Hat (there are no white hats here)? Excruciatingly clear and repetitive disclosure about what your doing and how it works.

Crypto: The Bet Against America

I’m pro crypto. I own a little crypto. I’ve been writing for about 10 years now that we (the U.S.) had the opportunity to lead in crypto, and instead chose to follow.

If one version of the techno-optimist/Fiat-is-a-crime/taxation-is-theft maxi-credo is right, then global fiat-based economic systems will spiral into a cycle of inflation and bad policy that is net-impoverishing and rife with social unrest. Those who put power-reserves (i.e. - excess capital) outside that system are metaphorically moving their chests full of shiny rocks to some island to wait out the chaos. In even a middling version of this scenario (which plenty are arguing is the now), then there is a massive wealth transfer

FROM:

the late-and-slow large pools of Fiat in the world (mostly the assets of governments {those would be *our* assets} and massive institutions).TO:

crypto enthusiasts who got in early enough.

Honestly, no notes. That’s exactly what’s happening.

Buying Bitcoin right now is primarily a hedge against American unreliability. For BTC to moon, people need to move out of something and into it, and overwhelmingly I believe people will sell dollars. If/When the Government decides to start buying BTC with my tax dollars, then the US will sell its own currency to purchase the stateless currency that is BTC. It’s foundationally a black hat trade. That doesn’t mean it’s an unprofitable trade, I just don’t see it as a fundamentally pro-human-flourishing one.

If there are white hat products and approaches here, I think its the very clear line in the sand between the major firms who’ve been working the ETF-Crypto problem for years with institutional clients and adoption (I’d highlight Bitwise and Grayscale) … and everyone else.

The challenge with Crypto (especially non-stupid, non-speculative crypto) remains the regulatory environment. Yes, we have Hester Peirce (clearly the best person for the job) heading up the working group at the SEC, but we’re still a long way from really understanding or even predicting exactly how TradFi is going to get yoinked by Crypto over the next 2-10 years.

I’m not a total idiot. I get how Crypto does good things in an imaginary fully-understood, well regulated global ecosystem — eventually. But one thing I’m very certain of is neither the SEC nor the CFPB nor FINRA nor the FDIC is going to bail you personally out of some dumb scam you fell for or some fat finger trade you made at 2AM on a Saturday after too much wine.

Building Trust in a Black Hat World

And thus …

Are you an investor? Turtle up. I don’t mean run for cash and sell all your stocks. I mean know exactly what every dollar you have allocated is supposed to do, and then ask your self if your partners are wearing white hats. Size and brand don’t matter at all anymore. Asset managers are *not* categorically on your side. They’re on their shareholders and executive compensation committee’s side. Ask yourself who you trust — at a personal, genuine, human level. That’s going to narrow your options a lot. Appropriately.

Are you an advisor? All of the above times 10. Not only do you need to really, really trust that your issuers, your trading platforms, your software providers, and your data sources are all white hat to the core. You need to be able to confidently exclaim that trust to your clients when the Poop Emoji hits the fan. Lean in to your most trusted relationships. Be ruthless in proving out new ones.

Wanna be a white hat ETF issuer? If your product development, marketing, PR and distribution isn’t building a baseline of real trust born from detailed, thoughtful, relevant communication and relationship building, you’re wearing the black hat. That’s OK. That’s a choice. Save all your money and advertise alongside DraftKings and Kalshi.

But otherwise: Prove you’re worth the trust. I used to default to trust in the ETF industry. For 30-odd years, “ETF” implied white hat.

Those days are sadly long gone.

—

Me Update: Mostly writing, making zines, doing podcasts and videos, working on book projects, and doing some retainer based consulting with white-hat ETF folks. If you’re one of those few, and want to rent my brain a bit, reach out. Otherwise, I’ll be doing a few podcasts a month over at Excess Returns, like this latest one with Matt Zeigler and Jason Buck. Cheers.

Well said. (FWIW, I was a long-time member of the staff of the SEC's Division of Investment Management.)

Ouch. Real. Thanks Dave.